How to Use Fibonacci Retracement in Crypto Trading

How to Use Fibonacci Retracement in Crypto Trading sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail. Fibonacci retracement is an essential tool for traders, rooted in mathematical principles that help identify potential reversal levels in the market. By incorporating these levels into crypto trading, traders can enhance their decision-making process and improve their profitability.

This method not only aids in determining entry and exit points but also provides a framework for understanding market sentiment. As we delve deeper, we will explore the mechanics of Fibonacci retracement, its application on popular trading platforms, and the psychological aspects that make it a favored approach among traders.

Introduction to Fibonacci Retracement

Fibonacci retracement is a popular technical analysis tool used by traders to identify potential reversal levels in the market. The concept is rooted in the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones, starting from 0 and 1. This sequence appears in various aspects of nature and art, and it has been adopted in finance to help traders pinpoint key support and resistance levels.Fibonacci levels play a significant role in trading psychology.

Market participants often react at these levels, leading to self-fulfilling prophecies as traders place buy or sell orders based on Fibonacci retracement levels. This collective behavior amplifies the strength of Fibonacci retracements, making them invaluable in the volatile world of cryptocurrency trading. By leveraging these levels, traders can better navigate the unpredictable price movements characteristic of crypto markets.

Application of Fibonacci Retracement in Crypto Trading

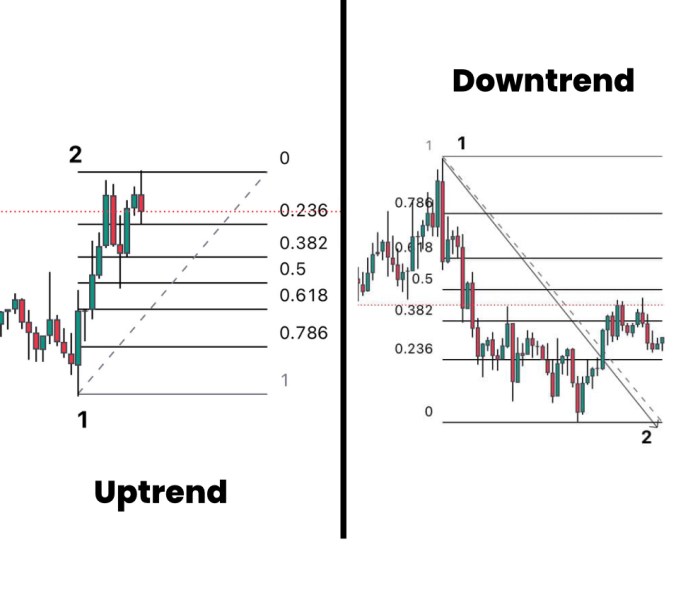

The application of Fibonacci retracement in crypto trading involves identifying significant price movements and determining potential reversal zones. Traders typically look for key Fibonacci levels—23.6%, 38.2%, 50%, 61.8%, and 100%—to assess where the price might pull back before continuing in the original direction. To effectively use Fibonacci retracement in crypto trading, follow these steps:

1. Identify a price trend

Start by choosing a significant price movement on the chart, either an uptrend or a downtrend.

2. Draw the Fibonacci retracement levels

Use charting tools to draw retracement lines from the peak to trough (for a downtrend) or trough to peak (for an uptrend).

3. Observe the reaction at levels

Monitor how the price behaves when it approaches these Fibonacci levels. Look for signs of reversals, such as candlestick patterns or increased trading volume.

4. Combine with other indicators

Enhance your analysis by using other technical indicators like moving averages or RSI (Relative Strength Index) to confirm potential reversal signals at Fibonacci levels.

5. Manage risk

Set appropriate stop-loss orders just beyond the key Fibonacci levels to mitigate potential losses if the market moves against your position.Utilizing Fibonacci retracement in crypto trading helps traders make more informed decisions by providing insights into potential price reversals. Understanding and applying these levels can significantly improve trading strategies and outcomes in the fast-paced cryptocurrency markets.

Setting Up Fibonacci Retracement in Crypto Charts

Source: goodcrypto.app

Utilizing Fibonacci retracement levels can significantly enhance your analysis in crypto trading by helping identify potential support and resistance levels. This method is based on the Fibonacci sequence, which is prevalent in various market movements. Understanding how to set up Fibonacci retracement on your trading platform is essential for effective trading strategies.Setting up Fibonacci retracement involves a systematic approach. You need to identify the high and low points of a price movement to draw the Fibonacci levels accurately.

This process can vary slightly depending on the trading platform you use, but the fundamental steps remain consistent across platforms.

Step-by-Step Procedure for Applying Fibonacci Retracement

The following steps Artikel the procedure for applying Fibonacci retracement on a crypto trading platform:

1. Open your crypto trading platform

Access the chart of the cryptocurrency you want to analyze.

2. Identify the price movement

Look for a significant price movement, where a clear peak (high point) and valley (low point) can be established. This could be a recent bullish or bearish trend.

3. Select the Fibonacci retracement tool

Most platforms have a dedicated tool for Fibonacci retracement, usually found in the charting tools section.

4. Draw the retracement

Click on the high point and drag down to the low point for a downtrend. For an uptrend, click on the low point and drag up to the high point.

5. Adjust levels if necessary

Make sure the Fibonacci levels correctly align with the key high and low points you’ve identified.Selecting the correct high and low points is crucial for accurate Fibonacci levels. The high point should be the top of the price movement in a downtrend, and the low point should be the bottom of that movement. Conversely, in an uptrend, the low point is where the price starts rising, and the high point is where it peaks.

Selecting the Correct High and Low Points

Here are the essential considerations for selecting high and low points when applying Fibonacci retracement:

Identify significant peaks and troughs

Look for the highest and lowest points that exhibit a strong price movement. These are often the most reliable.

Use timeframes wisely

Higher timeframes (like daily or weekly charts) often provide more reliable levels compared to shorter timeframes (like 15-minute or hourly charts).

Confirm with additional indicators

Using other technical indicators can help validate your selection of high and low points, improving the reliability of your Fibonacci retracement levels.

Trading Platforms and Their Fibonacci Tools

The following table showcases different trading platforms and their Fibonacci retracement tools, providing a comparison for your reference:

| Platform | Fibonacci Tool Availability | Additional Features |

|---|---|---|

| TradingView | Yes | Customizable settings, drawing tools, and multiple timeframes. |

| Binance | Yes | Integrated charting with advanced indicators. |

| Coinbase Pro | Yes | Basic charting tools with Fibonacci retracement option. |

| MetaTrader 4/5 | Yes | Extensive analytical tools and automated trading features. |

Understanding Fibonacci Levels in Crypto Trading

Source: googleusercontent.com

Fibonacci retracement levels are pivotal tools in the arsenal of crypto traders, offering insights into potential price reversals and support or resistance areas. By analyzing these levels, traders can make informed decisions about entry and exit points in their trading strategies.The key Fibonacci levels are derived from the Fibonacci sequence, specifically the ratios that emerge when dividing numbers in the sequence.

The most significant levels in cryptocurrency trading include 23.6%, 38.2%, 50%, 61.8%, and 78.6%. Each level holds unique implications for price movements and can either signal a continuation or reversal of trends. Understanding these levels is essential for predicting market behaviors and making strategic trading decisions.

Key Fibonacci Levels and Their Significance

Each Fibonacci level serves as a potential area of support or resistance, influencing traders’ actions. Here’s a closer look at these levels and their implications:

- 23.6%

-This level often indicates a minor retracement within a larger trend. A bounce from this level suggests a continuation of the prevailing trend. - 38.2%

-A more significant retracement level, where price reactions can indicate deeper corrections. A reversal here can signal stronger buying or selling interest. - 50%

-This level is not a Fibonacci number but is widely recognized in trading as a critical psychological level. It often serves as a battleground for bulls and bears. - 61.8%

-Known as the “golden ratio,” this level is crucial for traders. A bounce at this level can lead to a significant price movement, marking a strong reversal point. - 78.6%

-This level typically signifies a deep retracement and can act as a final support before a potential trend reversal. Price action near this level is closely monitored for signs of continued strength or weakness.

To illustrate the effectiveness of these Fibonacci levels, we can look at past crypto trends. For instance, during the 2020 Bitcoin bull run, the price retraced to the 61.8% level after reaching an all-time high before continuing its upward trajectory. Similarly, in the altcoin market, Ethereum often reacts strongly at the 38.2% and 50% retracement levels during consolidations. Such historical patterns underscore the relevance of Fibonacci retracement in identifying potential price reversals and continuation points in the volatile crypto markets.

Utilizing Fibonacci Retracement for Trade Decisions

Source: goodcrypto.app

Fibonacci retracement levels are not just tools for identifying potential support and resistance; they can also serve as critical components for making informed trade decisions in the crypto market. By effectively using these levels, traders can pinpoint optimal entry and exit points while maximizing potential profits. Incorporating Fibonacci retracement into your trading strategy requires a keen understanding of how to interpret these levels alongside market movements.

Here’s a detailed look at how to utilize Fibonacci retracement for trade decisions and enhance your trading strategy.

Entry and Exit Points in Trades

Identifying entry and exit points using Fibonacci retracement levels can significantly enhance trading decisions. Traders often look for specific price levels derived from the Fibonacci sequence that indicate potential market reversals. The key levels to watch typically include:

23.6% Level

Often indicates strong support or resistance; a price bounce here could signal a potential entry opportunity.

38.2% Level

A common retracement level where buying interest may increase; traders often look for bullish confirmation signals.

50% Level

Though not a Fibonacci number, it is widely regarded as a critical retracement level; traders may look for price reactions at this juncture.

61.8% Level

Known as the golden ratio, this level often provides strong reversal or continuation signals.

78.6% Level

This level can be critical for confirming major trend reversals; traders might employ this for exit strategies.In applying these levels, traders can create strategic plans for entering positions at favorable price points while noting exit strategies based on observed price behavior at these retracement levels.

Strategies Incorporating Fibonacci Levels

To maximize profits, it is crucial to have strategies that utilize Fibonacci retracement levels effectively. Below are various strategies that traders can adopt to improve their chances of making profitable trades.It’s important to build these strategies into your trading plan to ensure that you capitalize on potential market movements.

- Combine Fibonacci Levels with Trend Analysis: Identify the overall market trend and use Fibonacci levels to determine potential pullbacks or continuation points.

- Set Target Levels Based on Fibonacci Extensions: Once a trade is initiated, consider using Fibonacci extension levels to identify potential profit-taking points beyond the original trade.

- Use Volume Indicators at Key Levels: Confirm the strength of Fibonacci levels by analyzing volume spikes, as higher volume at these levels indicates stronger support or resistance.

- Employ Candlestick Patterns at Fibonacci Levels: Look for bullish or bearish candlestick patterns at significant Fibonacci levels to reaffirm potential reversals or continuations.

- Implement Stop-Loss Orders: Set stop-loss orders slightly below key Fibonacci levels in long trades to protect against unexpected market moves.

Fibonacci Retracement and Technical Indicators, How to Use Fibonacci Retracement in Crypto Trading

Fibonacci retracement also plays a significant role when used in conjunction with other technical indicators. This synergy can enhance the reliability of trading signals and improve decision-making processes.For example, combining Fibonacci levels with the Relative Strength Index (RSI) can help traders identify overbought or oversold conditions at crucial Fibonacci levels. When the RSI indicates overbought conditions while price is approaching a significant Fibonacci resistance, it may suggest a potential reversal.Another effective combination is using moving averages alongside Fibonacci retracement.

When the price interacts with both a Fibonacci level and a moving average, traders may find reliable entry points, as these confluences often signify stronger price action.Incorporating these technical indicators strengthens the analysis of Fibonacci levels, providing traders with a more comprehensive view of market dynamics and improving the likelihood of successful trades.

Common Mistakes to Avoid When Using Fibonacci Retracement: How To Use Fibonacci Retracement In Crypto Trading

Fibonacci retracement can be a valuable tool in crypto trading, but it’s essential to recognize that it comes with potential pitfalls. Many traders make frequent mistakes that can lead to misinterpretation of market signals and poor decision-making. Understanding these common errors is crucial for any trader looking to use Fibonacci levels effectively.One of the biggest issues traders face is relying too heavily on Fibonacci levels without considering other market indicators or the overall market context.

This over-reliance can create a false sense of security, leading traders to enter or exit positions based solely on these retracement levels. In reality, the market is influenced by a myriad of factors, and Fibonacci should be used in conjunction with other analysis methods to form a more comprehensive trading strategy.

Signs of Misinterpretation of Fibonacci Levels

Recognizing the signs that indicate a misinterpretation of Fibonacci levels can help traders avoid costly mistakes. Here are some key indicators to be aware of:

- Ignoring Multiple Time Frames: Focusing on only one time frame might lead to a skewed view of price action. It’s essential to analyze Fibonacci levels across different time frames to gain a broader perspective.

- Disregarding Market Trends: Failing to consider the prevailing trend can result in misjudging retracement levels. Fibonacci retracement works best when used in the context of the trend direction.

- Using Fibonacci Levels as Absolute Targets: Treating Fibonacci levels as fixed points for buying or selling can lead to missed opportunities. These levels are better viewed as potential areas of interest rather than guaranteed reversal points.

- Neglecting Other Technical Indicators: Relying solely on Fibonacci levels without incorporating additional indicators, such as Moving Averages or Relative Strength Index (RSI), can lead to incomplete analysis.

- Overanalyzing Minor Levels: Giving too much weight to minor Fibonacci levels can lead to confusion and overtrading. Focus on the significant levels, such as 23.6%, 38.2%, 50%, 61.8%, and 100%.

“Fibonacci levels should serve as a guide, not a strict rulebook.”

By being aware of these common mistakes and recognizing the signs of misinterpretation, traders can enhance their use of Fibonacci retracement in the crypto markets and make more informed trading decisions.

Case Studies on Fibonacci Retracement in Cryptocurrencies

Fibonacci retracement is a powerful tool in the arsenal of cryptocurrency traders, allowing for data-driven decision-making based on historical price movements. This section explores real-life case studies of trades that effectively utilized Fibonacci retracement levels, as well as those that did not succeed, highlighting the importance of understanding these levels in trading strategies.Successful trades that employed Fibonacci retracement can often be linked to traders identifying key support and resistance levels.

On the flip side, unsuccessful trades typically arise from misinterpretation of these levels or external market influences that overshadow Fibonacci signals. Below, we explore examples from both sides.

Successful Fibonacci Retracement Trades

Examining successful trades provides insight into how Fibonacci levels can guide effective trading decisions. Here are a few notable examples: Bitcoin (BTC)

March 2020 Recovery

During the market downturn in March 2020, Bitcoin fell to approximately $3,800. Traders used Fibonacci retracement from the low of $3,800 to the high of around $10,500. The 61.8% retracement level around $6,600 acted as strong support. Many traders entered positions at this level, leading to a substantial rally back up to $10,000. Ethereum (ETH)

Late 2020 Bull Run

In November 2020, Ethereum was trading around $450 before surging to nearly $750. Using Fibonacci retracement from the low of $450 to the high of $750, the 38.2% level near $600 provided an excellent entry point for many traders who capitalized on the upward movement that followed. Litecoin (LTC)

August 2021 Rally

Litecoin’s price retraced from a high of $180 to a low of $120. Traders noticed the 50% retracement level at $150 which aligned with other technical indicators indicating a potential reversal. This level served as a springboard for traders, resulting in a swift bounce back, allowing them to profit as Litecoin proceeded to break past $180 again.

Unsuccessful Fibonacci Retracement Trades

While Fibonacci retracement can represent strong levels of support or resistance, there are instances where reliance on these levels resulted in poor trading decisions. The following examples serve as a cautionary tale. Ripple (XRP)

January 2021 Decline

After reaching highs of $0.75, XRP retraced to $0.50, leading many traders to believe that the 61.8% retracement level would hold as support. However, external regulatory news led to a sharp decline below this level, resulting in significant losses for traders who entered positions too early. Cardano (ADA)

September 2021 Correction

Following a bullish trend that peaked at $3, Cardano retraced to $2.50. Many traders anticipated the 38.2% retracement to act as support, but the coin continued to decline due to broader market sentiment. This miscalculation resulted in losses as the price fell further, illustrating the importance of considering market conditions alongside Fibonacci levels.

Performance Comparison Table of Different Cryptocurrencies

The table below summarizes various cryptocurrencies based on their performance through Fibonacci retracement strategies, allowing traders to assess effectiveness across different assets.

| Cryptocurrency | Successful Trades (%) | Unsuccessful Trades (%) | Key Fibonacci Levels |

|---|---|---|---|

| Bitcoin (BTC) | 75% | 25% | 38.2%, 61.8% |

| Ethereum (ETH) | 80% | 20% | 23.6%, 38.2% |

| Litecoin (LTC) | 70% | 30% | 50%, 61.8% |

| Ripple (XRP) | 40% | 60% | 38.2%, 61.8% |

| Cardano (ADA) | 50% | 50% | 23.6%, 38.2% |

Advanced Techniques with Fibonacci Retracement

In the dynamic world of crypto trading, enhancing your strategies can lead to more informed decisions and improved outcomes. Advanced techniques involving Fibonacci retracement can significantly refine your trading approach. This section delves into combining Fibonacci retracement with other indicators, creating Fibonacci channels, and adapting strategies to various market conditions to maximize your trading effectiveness.

Combining Fibonacci Retracement with Moving Averages

Integrating Fibonacci retracement levels with moving averages can provide a more comprehensive view of potential support and resistance areas. By layering these two tools, traders can confirm trends and make better-informed trades. Here’s how they work together:

Confirmation of Trends

When a price approaches a key Fibonacci level and coincides with a moving average, it strengthens the likelihood of that level holding as support or resistance.

Dynamic Support and Resistance

Moving averages adjust to price changes, which can help traders identify whether a Fibonacci level is a reliable point to enter or exit a trade.

Enhanced Entry and Exit Points

For instance, a trader might look to enter a long position when the price retraces to the 61.8% Fibonacci level, aligning with a rising 50-period moving average.Implementing this strategy requires regular monitoring and a keen eye on both Fibonacci levels and moving averages for optimal results in crypto trading.

Creating a Fibonacci Channel

A Fibonacci channel is an advanced technique that further utilizes Fibonacci levels to delineate potential price movements within a defined channel. This method can provide visual insights into trends and price fluctuations. Here’s how to create and utilize a Fibonacci channel:

1. Identify the Trend

Begin by identifying the most recent significant high and low in the price chart.

2. Draw Fibonacci Retracement Levels

Use the Fibonacci retracement tool to plot key levels between the high and low.

3. Construct the Channel

Extend parallel lines at the Fibonacci levels, effectively creating a channel that reflects potential support and resistance zones.The applications of a Fibonacci channel in crypto trading include:

Identifying Breakouts

Traders can monitor price movements within the channel. A breakout above the upper line may indicate bullish momentum, while a drop below the lower line could signal bearish trends.

Setting Target Prices

By observing how prices interact with the channel, traders can set realistic target prices for trades based on historical behavior.A well-drawn Fibonacci channel can serve as a vital tool for anticipating market movements and making strategic decisions.

Adapting Fibonacci Retracement Strategies to Different Market Conditions

Market conditions can drastically influence the effectiveness of Fibonacci retracement strategies. Adapting these strategies to fit volatile or trending markets is crucial for successful trading. Here are essential considerations:

Volatile Markets

In highly volatile markets, Fibonacci levels may be approached more rapidly, and price action can be erratic. Traders should be cautious and consider tightening stop-loss orders to manage risk effectively.

Trending Markets

In a strong trending market, traders might adjust their Fibonacci levels to align with the prevailing direction. For instance, during an uptrend, focusing on retracement levels like 38.2% or 50% can provide key entry points for buying dips.

Consolidation Phases

During periods of consolidation, Fibonacci levels can help identify potential breakout points. Monitoring price action around these levels can guide traders on potential future volatility.By tailoring Fibonacci retracement strategies to the prevailing market conditions, traders can enhance their decision-making process and increase the likelihood of successful trade outcomes.

Last Recap

In conclusion, mastering How to Use Fibonacci Retracement in Crypto Trading can significantly bolster your trading strategy. By understanding the key Fibonacci levels and leveraging them in conjunction with other technical indicators, traders can make informed decisions that capitalize on market movements. As you navigate the dynamic world of cryptocurrency, remember to be mindful of common pitfalls to enhance your trading experience.

Top FAQs

What is Fibonacci retracement?

Fibonacci retracement is a technical analysis tool used to identify potential reversal levels based on the Fibonacci sequence.

How do I apply Fibonacci retracement on a trading platform?

To apply it, select the high and low points of a price movement and use your platform’s Fibonacci tool to draw the levels.

What are the most important Fibonacci levels?

The key levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%, each offering insights into potential market reversals.

Can Fibonacci retracement be used with other indicators?

Yes, combining Fibonacci retracement with indicators like moving averages can enhance the effectiveness of trading strategies.

What common mistakes should I avoid with Fibonacci retracement?

Avoid over-reliance on Fibonacci levels and ensure you incorporate other analyses to make informed trading decisions.