How to Earn Passive Income With Crypto Effortlessly

With How to Earn Passive Income With Crypto at the forefront, many are intrigued by the myriad opportunities presented by the digital currency revolution. Cryptocurrencies have transformed the financial landscape, enabling individuals to earn money even while they sleep. This guide will walk you through the essentials of passive income through crypto, including methods, risks, tools, and real-life examples that highlight its potential.

Understanding the concept of passive income is crucial in today’s economy, especially as traditional income sources become less reliable. As we delve into the world of cryptocurrencies, we will explore how various methods such as staking, yield farming, and lending can help you generate income with minimal effort. By integrating cryptocurrencies into your investment strategy, you can tap into a rapidly growing market while diversifying your income streams.

Understanding Passive Income

Passive income represents earnings derived from ventures in which a person is not actively involved on a day-to-day basis. This concept is significant in personal finance as it allows individuals to build wealth over time without the continual effort typically required by active income sources. Essentially, passive income enables individuals to earn money while focusing on other aspects of life or pursuing additional opportunities.Traditional sources of passive income can include various investment vehicles and business models.

For instance, rental income from real estate properties is a classic example, where property owners earn monthly payments from tenants without needing to actively manage their tenants daily. Similarly, dividends earned from stocks, interest from savings accounts, and income generated from bonds also serve as traditional passive income streams. These income sources are crucial for financial planning, as they can provide a safety net or financial freedom in retirement.

Advantages of Earning Passive Income Through Cryptocurrencies

Investing in cryptocurrencies offers unique advantages for generating passive income, setting it apart from traditional investments. The digital nature of cryptocurrencies provides opportunities for innovative income strategies that can yield substantial returns. Here are some key advantages:

- High Potential Returns: Cryptocurrencies can yield significantly higher returns compared to traditional investments, driven by their volatile nature. For instance, yield farming in decentralized finance (DeFi) can offer annual percentage yields (APYs) that can reach well over 100% in certain cases.

- Diversification: Cryptocurrencies allow for diversification of an investment portfolio. By allocating funds across various digital assets, investors can mitigate risks associated with market fluctuations.

- Global Accessibility: Cryptocurrencies are accessible to anyone with an internet connection, eliminating geographical barriers. This feature opens up opportunities for passive income to individuals in regions where traditional banking services may be limited.

- Ownership and Control: By investing in cryptocurrencies, individuals retain ownership and control over their assets. Unlike traditional investments, cryptocurrencies can be stored in personal wallets, providing users with direct access to their funds at all times.

Additionally, many cryptocurrencies provide mechanisms to earn passive income directly through staking or lending. For example, staking allows holders of certain cryptocurrencies to participate in network validation processes while earning rewards, often resulting in a steady stream of income over time.

“The future of finance is decentralized, and earning passive income through cryptocurrencies is at the forefront of this financial revolution.”

Introduction to Cryptocurrency

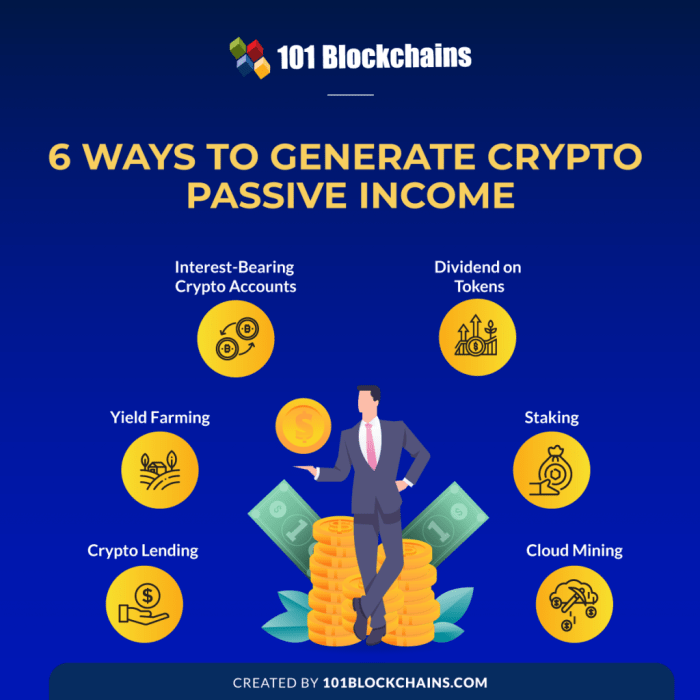

Source: 101blockchains.com

Cryptocurrency has revolutionized the financial landscape, presenting new opportunities for investment and financial freedom. At its core, cryptocurrency is a digital or virtual form of currency that uses cryptography for security, making it difficult to counterfeit or double-spend. This innovative technology is based on blockchain, a decentralized ledger that records all transactions across a network of computers, ensuring transparency and security.The history of cryptocurrency dates back to the late 2008 when an individual or group of individuals under the pseudonym Satoshi Nakamoto introduced Bitcoin, the first decentralized cryptocurrency.

Released in 2009, Bitcoin laid the groundwork for a new era in digital finance. Over the years, the cryptocurrency market has evolved significantly, with thousands of alternative cryptocurrencies (often referred to as altcoins) emerging, each with unique features and purposes. Notably, Ethereum, introduced in 2015, expanded the blockchain’s capabilities by allowing the creation of smart contracts, which automate transactions based on predetermined conditions.

Popular Cryptocurrencies for Earning Passive Income

Various cryptocurrencies enable users to earn passive income through staking, lending, or yield farming. These methods allow individuals to generate returns on their investments without active trading. Below are some of the most popular cryptocurrencies known for their potential in earning passive income:

- Ethereum (ETH): By participating in Ethereum’s staking program, users can earn rewards while contributing to the network’s security and functionality.

- Cardano (ADA): Cardano offers a staking mechanism that allows users to earn ADA rewards by delegating their tokens to a stake pool.

- Polkadot (DOT): DOT holders can stake their tokens to earn rewards and participate in the governance of the network.

- Tezos (XTZ): Users can earn XTZ through a process called baking, where they validate transactions and create new blocks.

- Chainlink (LINK): Certain platforms allow LINK holders to lend their tokens, earning interest while maintaining ownership.

The potential for passive income in the cryptocurrency space is significant, and understanding these options can help investors take advantage of the unique benefits offered by each cryptocurrency. With the right strategies and research, individuals can leverage these digital assets to grow their wealth over time.

Methods to Earn Passive Income with Crypto: How To Earn Passive Income With Crypto

Earning passive income with cryptocurrency has gained significant traction among investors and enthusiasts alike. With the landscape of digital assets constantly evolving, various methods have emerged that allow individuals to generate income without active involvement. This section delves into three primary methods: staking, yield farming within decentralized finance (DeFi), and lending services. Each method offers unique mechanisms and rewards that cater to different investor preferences.

Staking as a Method for Generating Passive Income

Staking involves participating in a Proof of Stake (PoS) blockchain network by locking up a certain amount of cryptocurrency in a wallet to support network operations, such as block validation and transaction processing. By doing so, users earn rewards in the form of additional cryptocurrency, typically reflecting a percentage of the staked amount. One of the appealing aspects of staking is its relatively low barrier to entry, as many cryptocurrencies offer competitive staking rewards.

For instance, Ethereum 2.0 allows users to stake a minimum of 32 ETH to become a validator, while other platforms may require significantly lower amounts. The staking process often entails selecting a suitable wallet or exchange that supports staking capabilities. Users can either run their own validator node or delegate their tokens to a staking pool, where rewards are distributed collectively among participants.

Staking can yield annual percentage yields (APY) ranging from 5% to 20%, depending on the specific cryptocurrency and network conditions.

Yield Farming within Decentralized Finance (DeFi)

Yield farming is a more advanced method for generating passive income that operates within the DeFi ecosystem. It involves lending or staking cryptocurrencies in exchange for interest or additional tokens. By utilizing smart contracts on decentralized platforms, yield farmers can maximize their returns by strategically moving their assets across various protocols based on the best available yields.The yield farming process typically requires users to provide liquidity to decentralized exchanges (DEXs) or lending platforms.

In return, they receive liquidity provider (LP) tokens, which represent their share of the liquidity pool. These LP tokens can then be further utilized in other DeFi applications, creating a compounding effect on returns.Yield farmers must navigate variable interest rates, impermanent loss, and smart contract risks, making it essential to conduct thorough research before participating. Some notable protocols include Compound, Aave, and Uniswap, each offering different strategies and potential returns.

Yield farming can provide returns ranging from 10% to over 100% APY, depending on market conditions and protocol incentives.

Platforms Offering Lending Services for Passive Income

Lending services in the crypto space allow users to lend their assets to others in exchange for interest payments. This method has become increasingly popular as it offers a straightforward way to earn passive income without needing to actively manage investments.Numerous platforms facilitate crypto lending, each with varying terms and interest rates. Below is a list of some prominent platforms offering lending services:

- BlockFi: Provides interest accounts for various cryptocurrencies, with rates generally ranging from 4% to 8% APY.

- Celsius Network: Offers users the ability to earn interest on their crypto deposits, often exceeding 10% APY.

- Crypto.com: Users can earn interest on a wide array of cryptocurrencies, with rates up to 12% APY depending on the coin and terms.

- Nexo: Allows instant crypto loans and pays interest on deposits, with rates around 8% APY.

- Binance: Features a lending program that allows users to lend their crypto on flexible or fixed terms, often yielding competitive rates.

By choosing the right platform and understanding the terms involved, users can effectively utilize lending services to grow their crypto portfolios passively.

Risks and Considerations

Source: robofi.io

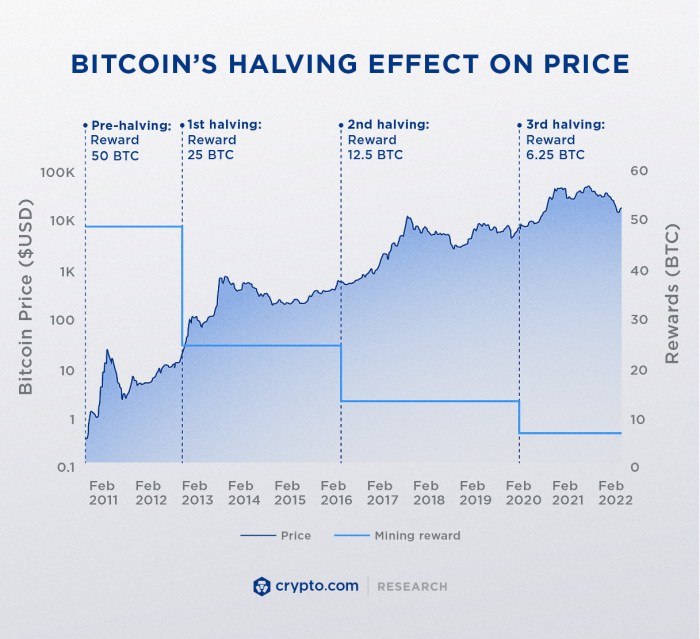

Earning passive income through cryptocurrency can be an enticing opportunity, but it comes with its own set of risks and considerations. Understanding these risks is crucial for anyone looking to invest in the world of crypto, as the potential for profit can often be accompanied by significant volatility and uncertainty.The cryptocurrency market is known for its high volatility, primarily driven by a range of factors that can lead to rapid price fluctuations.

These factors include market sentiment, regulatory news, technological advancements, and macroeconomic trends. Investors need to be aware that a minor event can lead to substantial price changes, which can directly impact earnings from passive income strategies.

Volatility Factors in Cryptocurrency Prices

Numerous elements contribute to the volatility of cryptocurrency prices, and acknowledging these can help investors better prepare for market swings. Here are some key factors:

- Market Sentiment: The perception and emotions of investors play a significant role in driving price movements. Positive news can cause prices to surge, while negative news can lead to sharp declines.

- Regulatory Developments: Changes in government regulations or legal frameworks can greatly affect investor confidence and market stability, leading to price volatility.

- Technological Changes: Innovations or updates in blockchain technology can impact a cryptocurrency’s utility, leading to shifts in market demand and price.

- Market Manipulation: Due to the relatively low liquidity in some cryptocurrencies, large trades can lead to significant price changes, raising concerns about market integrity.

- Global Economic Factors: Economic events such as inflation, currency devaluation, or financial crises can influence the crypto market, as investors may view digital assets as a hedge against traditional financial systems.

Strategies for Mitigating Risks

While risks in the cryptocurrency space are prevalent, there are several strategies that investors can employ to mitigate them while pursuing passive income:

- Diversification: Spreading investments across various cryptocurrencies and other asset classes can help reduce the impact of a single asset’s poor performance.

- Education and Research: Staying informed about market trends, technological advancements, and regulatory changes can empower investors to make sound decisions and identify potential risks early.

- Setting Clear Goals: Establishing clear investment goals and timelines allows investors to make strategic decisions based on their risk tolerance and market conditions.

- Using Stop-Loss Orders: Implementing stop-loss orders can protect against significant losses by automatically selling an asset once it reaches a certain price.

- Regular Portfolio Review: Continuously assessing and adjusting your investment portfolio in response to changing market conditions can help manage risk effectively.

Tools and Resources

To successfully navigate the world of passive income through cryptocurrency, having the right tools and resources at your disposal can make a significant difference. These resources not only simplify the process but also provide valuable insights that can enhance your investment strategies. Here, we’ll cover various platforms, educational resources, and community forums that are essential for anyone looking to earn passive income with crypto.

Platforms for Passive Income Generation

A variety of platforms enable individuals to earn passive income through different methods such as staking, lending, and yield farming. These platforms cater to various user needs and preferences, offering unique features that can enhance income potential.

- Binance Earn: A comprehensive platform offered by Binance that allows users to earn interest on their crypto holdings through various saving and staking options.

- Celsius Network: A popular app that offers high-interest rates on crypto deposits and allows users to earn passive income by lending their digital assets.

- Aave: A decentralized lending protocol where users can lend and borrow cryptocurrencies, earning interest on their deposits while taking advantage of innovative features like flash loans.

- Compound: Another decentralized finance (DeFi) protocol enabling users to earn interest on their crypto assets by lending them out to borrowers.

- BlockFi: A platform that offers interest-earning accounts for cryptocurrencies, allowing users to earn up to 8.6% APY on their holdings.

Educational Resources for Passive Income Strategies

Staying informed is crucial in the rapidly evolving cryptocurrency landscape. There are numerous educational resources available to help individuals understand passive income strategies better and enhance their overall knowledge of cryptocurrency.

- Online Courses: Platforms like Coursera and Udemy offer various courses on cryptocurrency basics, trading strategies, and specific passive income strategies such as staking and yield farming.

- Books: There are several insightful books on cryptocurrency and passive income strategies, such as “The Basics of Bitcoins and Blockchains” by Antony Lewis, which provides foundational knowledge for beginners.

- Webinars and Workshops: Many financial experts and crypto enthusiasts host webinars and workshops that cover current trends and strategies for earning passive income with crypto.

- YouTube Channels: Channels like Coin Bureau and DataDash offer extensive tutorials and insights on cryptocurrency investments, including strategies for passive income.

Community Forums and Support Groups

Engaging with community forums and support groups can provide invaluable insights and foster networking opportunities. These platforms allow individuals to share experiences, ask questions, and gain practical knowledge about earning passive income with cryptocurrency.

- Reddit: Subreddits like r/CryptoCurrency and r/Passive_Income are vibrant communities where users share tips, strategies, and news regarding earning passive income through crypto.

- Discord Groups: Various Discord servers exist focused on cryptocurrency discussions, with channels dedicated to passive income strategies, where members can share resources and insights.

- Telegram Groups: Telegram hosts numerous groups focused on cryptocurrency trading and passive income strategies, providing real-time updates and community support.

- Facebook Groups: There are many Facebook groups dedicated to cryptocurrency investing and passive income, where members frequently engage in discussions about their experiences and strategies.

Tax Implications

Navigating the tax landscape for passive income derived from cryptocurrency can be intricate and varies significantly across jurisdictions. Understanding how these earnings are taxed is essential to ensure compliance and optimize your financial strategies.Tax obligations related to cryptocurrency passive income can differ widely, depending on where you reside. In many countries, cryptocurrency is treated as property, and any gains from its sale or exchange may be subject to capital gains tax.

For instance, in the United States, the IRS specifies that any profit realized from the sale of cryptocurrency is taxable, regardless of whether it’s used for passive income activities like staking or yield farming. In contrast, some jurisdictions may have more favorable tax treatments for cryptocurrency, potentially offering lower rates or exemptions for specific types of income.

Record-Keeping for Crypto Transactions

Maintaining accurate records of all cryptocurrency transactions is critical for tax reporting and compliance. This includes every purchase, sale, and exchange of crypto assets, as well as any income derived from staking, lending, or yield farming. Effective record-keeping practices should encompass the following aspects:

- Transaction Dates: Documenting the exact date of each transaction helps in calculating the holding period and determining short-term versus long-term capital gains.

- Amount and Value: Record the amount of cryptocurrency involved and its fair market value at the time of each transaction to accurately report gains or losses.

- Purpose of Transactions: Clearly state whether the transaction was for personal use, investment, or passive income generation to simplify tax categorization.

- Fees and Costs: Keep track of any transaction fees paid, as these can be deducted from your taxable income.

Implementing a reliable tracking system, such as using specialized software or spreadsheets, is advisable to streamline this process.

Strategies for Legal Tax Optimization

Employing legal strategies to optimize tax liabilities concerning crypto earnings is crucial for maximizing your returns. Here are some effective approaches:

- Tax Loss Harvesting: This strategy involves selling assets that have decreased in value to offset gains from profitable sales. This can reduce the overall tax burden.

- Utilizing Tax-Advantaged Accounts: In certain jurisdictions, holding cryptocurrencies in tax-advantaged accounts (like IRAs in the U.S.) can defer taxes on gains until withdrawal.

- Long-Term Holding: By holding onto cryptocurrencies for over a year, many jurisdictions allow lower capital gains tax rates for long-term investments compared to short-term gains.

- Charitable Donations: Donating appreciated cryptocurrency to qualified charities can provide a tax deduction for the fair market value while avoiding capital gains tax on the appreciation.

It is wise to consult with a tax professional familiar with cryptocurrency taxation to tailor these strategies to your individual circumstances, ensuring compliance while taking full advantage of available benefits.

Real-Life Case Studies

Many individuals and businesses have successfully harnessed the potential of cryptocurrency to generate passive income. These case studies illustrate various strategies that can be employed to create a sustainable income stream while navigating the dynamic world of digital assets. By analyzing these examples, we can uncover valuable insights and actionable lessons for anyone looking to replicate their success in the realm of crypto.

Successful Individuals in Crypto Passive Income

One notable example is Anthony Pompliano, a well-known figure in the cryptocurrency space. Pompliano has leveraged various income-generating methods, such as staking and lending, to create a consistent flow of passive income. His strategy primarily involves investing in established cryptocurrencies like Bitcoin and Ethereum, where he utilizes platforms that offer staking services. This allows him to earn rewards simply by holding onto his assets.Another exemplary case is the venture by the company Celsius Network, which has transformed how individuals think about earning interest on their crypto holdings.

Celsius offers users the opportunity to deposit their cryptocurrencies and earn interest on them through a range of lending options. For instance, a user depositing Bitcoin could earn up to 6% annual interest, providing a significant return without the need for active trading. The platform’s model emphasizes transparency and rewards users with higher interest rates based on their loyalty and the amount they deposit.

Strategies Employed for Continuous Income

The strategies used by these individuals and entities can be categorized as follows:

- Staking: Investors can lock up their cryptocurrencies for a set period to support the network operations, receiving rewards in the form of additional tokens.

- Lending: By lending cryptocurrencies through platforms like BlockFi or Celsius, users earn interest on their deposits, generating a steady income stream.

- Yield Farming: This involves providing liquidity to decentralized finance (DeFi) protocols in exchange for returns, often resulting in high yield rates.

These strategies highlight the importance of understanding the underlying mechanisms of each approach. For example, staking not only contributes to network security but also rewards users, creating a win-win situation.

“The key to successful passive income in crypto lies in diversification and understanding the tools at your disposal.”

Lessons Learned from Real-Life Examples, How to Earn Passive Income With Crypto

From these case studies, several lessons can be gleaned that may be helpful for aspiring investors:

- Do thorough research: Understanding the risks and rewards associated with different cryptocurrencies and platforms is crucial before committing to any investments.

- Start small: Beginners should consider starting with a modest investment to gauge their comfort level and gradually increase their exposure as they gain experience.

- Diversify your portfolio: To mitigate risk, it is advisable to spread investments across multiple assets and strategies, rather than putting all funds into one option.

- Stay informed: The crypto landscape evolves rapidly; staying updated with market trends and regulatory changes can help optimize investment strategies.

By analyzing these real-life examples and the strategies employed, one can gain a clearer understanding of how to approach passive income generation in the cryptocurrency sector. The possibilities are vast, and with the right knowledge and approach, success is attainable.

Ending Remarks

Source: bitdeer.com

In conclusion, the potential to earn passive income with cryptocurrencies offers an exciting avenue for financial growth and independence. By understanding the various methods available, assessing the associated risks, and utilizing the right resources, anyone can embark on this journey of crypto investing. Whether you’re a seasoned investor or just starting out, the world of crypto provides numerous opportunities to secure your financial future while enjoying the benefits of innovative technology.

FAQ Explained

What is passive income in the context of crypto?

Passive income in crypto refers to earnings generated from investments or assets without active involvement, such as staking or yield farming.

Is passive income from crypto safe?

While there are risks involved, using reputable platforms and understanding the market can mitigate some dangers associated with crypto investments.

How can I start earning passive income with crypto?

Begin by researching various methods like staking, yield farming, and lending, and choose a strategy that aligns with your investment goals.

Do I need a lot of money to earn passive income with crypto?

No, many platforms allow you to start with a small investment, making it accessible for individuals with varying budgets.

How are earnings from crypto taxed?

Taxation on crypto earnings varies by jurisdiction, so it is essential to understand local laws regarding taxes on cryptocurrency income.