Why Crypto Is Volatile and How to Manage It Effectively

Why Crypto Is Volatile and How to Manage It sets the stage for this enthralling narrative, offering readers a glimpse into the complex world of cryptocurrency where price swings can be both dramatic and daunting. As digital assets gain popularity, understanding the inherent volatility becomes crucial for investors. This discussion will explore the factors that contribute to these fluctuations, the psychological aspects of trading, and effective strategies to navigate the often-turbulent crypto landscape.

The journey through the realm of crypto volatility reveals the underlying mechanics that drive market changes, from external influences like regulatory shifts to the emotional responses of investors. By examining these elements, we can better equip ourselves to make informed trading decisions and potentially mitigate risks associated with cryptocurrency investments.

Understanding Crypto Volatility

Cryptocurrency volatility refers to the rapid and unpredictable price movements commonly observed in the crypto markets. Unlike traditional financial assets, cryptocurrencies can experience extreme price changes within short time frames, making them both an opportunity and a risk for investors.Volatility in cryptocurrency markets is influenced by various factors, including market sentiment, liquidity, regulatory news, and technological developments. The decentralized nature of cryptocurrencies also leads to less price stability compared to conventional stocks or bonds.

As a result, traders and investors must stay informed about these factors to navigate the turbulent waters of crypto trading effectively.

Factors Contributing to High Volatility, Why Crypto Is Volatile and How to Manage It

Understanding the elements that contribute to volatility is crucial for anyone involved in cryptocurrency investments. Here are some key factors:

- Market Sentiment: Cryptocurrencies are significantly affected by public perception. Positive news can lead to rapid price increases, while negative news can trigger steep declines.

- Liquidity Issues: Many cryptocurrencies have lower trading volumes compared to traditional assets, making it easier for large trades to impact prices dramatically.

- Regulatory Changes: Announcements regarding government regulations or bans can create instant panic or euphoria, leading to swift price adjustments.

- Technological Developments: Upgrades or bugs in blockchain technology can influence investor confidence, impacting prices either positively or negatively.

- Market Manipulation: The crypto market can be susceptible to manipulation tactics, such as pump-and-dump schemes, which can lead to sudden price spikes or drops.

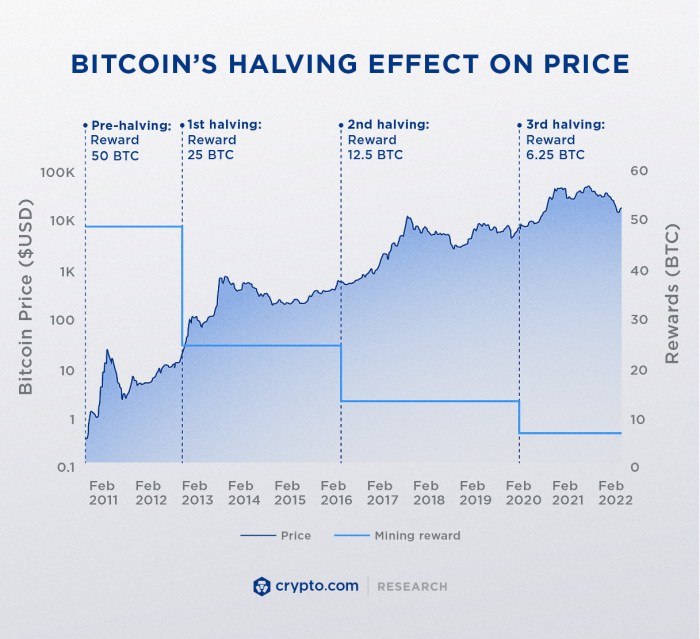

Examples of Significant Price Fluctuations

Historical data reveals some extreme price fluctuations in popular cryptocurrencies that highlight their volatility. Consider the following instances:

- Bitcoin (BTC): In December 2017, Bitcoin reached an all-time high of nearly $20,000, only to plummet to around $3,200 by December 2018, showcasing a staggering 84% decline.

- Ethereum (ETH): Ethereum’s price surged from approximately $10 in January 2017 to over $1,400 by January 2018, followed by a drop to around $80 by December 2018, reflecting its inherent volatility.

- DogeCoin (DOGE): Initially created as a meme, Dogecoin surged from $0.005 in early 2021 to over $0.70 in May, before crashing back to around $0.20, illustrating the speculative nature of crypto investments.

These examples emphasize the unpredictable nature of cryptocurrencies, reinforcing the need for caution and strategic planning for anyone looking to invest in this dynamic market.

Market Influences on Cryptocurrency Prices

Source: pixabay.com

The cryptocurrency market is characterized by its inherent volatility, influenced by a myriad of external factors. Understanding these market influences is crucial for investors aiming to navigate the ever-changing landscape of digital currencies. This section delves into external events such as regulatory changes and technological advancements, as well as the significant role of market sentiment and news in driving price fluctuations.The dynamics of cryptocurrency prices are shaped by a variety of external influences.

Regulatory changes, for instance, can have immediate and profound effects on market behavior. When a government announces stricter regulations on cryptocurrency trading, market participants may react swiftly, leading to price declines. Conversely, positive regulatory news, such as the recognition of cryptocurrencies as legal tender, can spark price surges. Technological advancements also play a pivotal role; upgrades to blockchain networks, such as Ethereum’s transition to a proof-of-stake model, can instill investor confidence and influence pricing trends.

External Events Influencing Crypto Prices

Several external events significantly impact the volatility of cryptocurrency prices. Understanding these events helps investors gauge potential market movements. Key influences include:

- Regulatory Announcements: Any new regulations or government stances on cryptocurrencies can lead to significant price adjustments.

- Technological Innovations: Upgrades and improvements in blockchain technology can enhance security and scalability, attracting more investors.

- Market Adoption: Growing acceptance of cryptocurrencies by businesses and consumers can drive demand and increase prices.

- Economic Indicators: Global economic conditions, such as inflation rates or stock market performance, can influence investor sentiment towards cryptocurrencies.

- Geopolitical Events: Political instability or conflict can impact investor confidence, leading to abrupt price shifts.

Market sentiment and news are critical drivers of price fluctuations in the cryptocurrency space. The emotional responses of investors to news stories, whether positive or negative, can lead to rapid buying or selling. For example, speculation about institutional adoption can create bullish sentiment, causing prices to soar. Conversely, negative news, such as hacks or fraud in the cryptocurrency sphere, can trigger panic selling.

Comparison of Cryptocurrency Volatility with Traditional Assets

To put cryptocurrency volatility into perspective, it’s essential to compare it with traditional assets like stocks and bonds. The following table illustrates the typical volatility levels associated with these different asset classes:

| Asset Class | Typical Volatility (Annualized) | Example |

|---|---|---|

| Cryptocurrency | 50% – 100%+ | Bitcoin |

| Stocks | 15% – 20% | S&P 500 |

| Bonds | 3% – 5% | US Treasury Bonds |

This comparison highlights the extreme volatility inherent in the cryptocurrency market when juxtaposed with traditional investment avenues. Investors should proceed with caution, keeping in mind that while potential for high returns exists, the risks are equally significant.

“Understanding market influences is crucial for navigating the volatile landscape of cryptocurrency investments.”

Investor Behavior and Market Psychology

The behavior of investors and the psychology behind trading decisions play a crucial role in the volatility of cryptocurrency markets. Unlike traditional markets, cryptocurrencies are heavily influenced by emotional reactions, leading to sharp price fluctuations. Understanding these psychological factors can provide insights into potential market trends and help investors manage their strategies effectively.Investor emotions, such as fear and greed, can significantly impact trading decisions and market dynamics.

When the market experiences a downturn, fear can lead to panic selling, causing prices to plummet. Conversely, during market upswings, the fear of missing out (FOMO) can drive investors to make impulsive purchases, further inflating prices. This emotional rollercoaster creates a feedback loop that can exacerbate volatility. Recognizing these emotions and their effects can be instrumental for investors looking to navigate the turbulent waters of crypto trading.

Analyzing Investor Sentiment

Understanding investor sentiment is essential for anticipating market movements. Social media and news platforms serve as vital resources for gauging public opinion and emotions related to cryptocurrencies. By analyzing trends in discussions and sentiment across these platforms, investors can gain insights into market psychology.For instance, sentiment analysis can be performed using tools that track s and hashtags associated with cryptocurrencies.

Platforms like Twitter and Reddit provide real-time discussions that can indicate bullish or bearish sentiments. Monitoring news articles and press releases can also highlight factors that influence investor perceptions, such as regulatory changes or technological advancements in the crypto space.

Common Psychological Traps

Investors often fall into psychological traps that can lead to poor decision-making and increased volatility. Recognizing these traps can help investors make more rational choices. Below is a list of some common psychological traps that crypto investors encounter:

- Loss Aversion: Investors tend to fear losses more than they value gains, which can lead to holding onto losing positions for too long.

- Overconfidence: Many investors overestimate their knowledge or ability to predict market movements, leading to reckless trades.

- Herd Behavior: Investors often follow the crowd, buying or selling based on the actions of others rather than their own analysis.

- Confirmation Bias: Investors may seek information that confirms their existing beliefs while ignoring evidence that contradicts them.

- Recency Bias: Recent market events tend to overly influence investors’ perceptions, leading them to make decisions based on short-term trends.

- FOMO and FUD: Fear of missing out on potential gains or fear, uncertainty, and doubt can drive impulsive decisions that lead to financial losses.

Risk Management Strategies for Crypto Investors

Source: publicdomainpictures.net

Investing in cryptocurrency can be a thrilling yet risky endeavor. Given the market’s notorious volatility, understanding and implementing effective risk management strategies is essential for anyone looking to safeguard their investments. This section will explore various techniques tailored specifically for cryptocurrency investments, ensuring that investors can navigate this complex landscape with more confidence.

Risk Management Techniques

There are several risk management techniques that can help cryptocurrency investors minimize their exposure to potential losses while maximizing their returns. Here are a few key strategies:

- Position Sizing: Determining the optimal size of each investment is crucial. This involves assessing your total capital, risk tolerance, and the specific asset’s volatility. A common rule is to risk only a small percentage (usually between 1-3%) of your total capital on a single trade.

- Stop-Loss Orders: Setting stop-loss orders allows investors to automatically sell a cryptocurrency when it reaches a predetermined price. This helps limit potential losses. For instance, if you buy Bitcoin at $40,000, you might set a stop-loss at $36,000 to prevent further losses if the price drops.

- Diversification: Spreading investments across various cryptocurrencies can reduce risk. This strategy involves not putting all your funds into one asset, which can expose you to higher volatility. A well-diversified crypto portfolio might include Bitcoin, Ethereum, and several altcoins.

- Risk-Reward Ratio: Analyzing the potential risk versus the potential reward for each trade is essential. A common strategy is to aim for a minimum risk-reward ratio of 1:2, meaning for every dollar risked, you aim to make at least two dollars.

Setting Stop-Loss and Take-Profit Orders

Utilizing stop-loss and take-profit orders can significantly enhance an investor’s ability to manage risks effectively. Here’s a comprehensive guide to setting these orders successfully:

1. Determine Your Risk Tolerance

Before setting any orders, assess how much loss you are willing to accept. This will help you determine appropriate stop-loss levels.

2. Identify Support and Resistance Levels

Analyze the price chart to find key support (price levels where a downtrend may halt) and resistance (price levels where an uptrend may halt) levels. Position your stop-loss slightly below support and your take-profit slightly below resistance.

3. Use a Percentage Approach

A common method is to set a stop-loss at a certain percentage below the purchase price, such as 5-10%. For example, if you buy Ethereum at $3,000 and set a stop-loss at 10%, your order would trigger if the price falls to $2,700.

4. Regularly Adjust Orders

As the price of a cryptocurrency fluctuates, regularly revisit and adjust your stop-loss and take-profit levels to reflect new support and resistance levels.

“Effective use of stop-loss and take-profit orders can help investors automate their trading strategies and minimize emotional decision-making.”

Diversification Strategies for Crypto Portfolios

Diversifying your cryptocurrency investments is an effective strategy for managing risk. Here’s how to diversify your portfolio comprehensively:

- Invest in Different Market Caps: Allocate funds among large-cap cryptocurrencies (like Bitcoin and Ethereum), mid-cap coins, and small-cap altcoins. Large-cap coins tend to be more stable, while small-cap coins can offer higher returns.

- Spread Across Sectors: Consider investing in cryptocurrencies from various sectors such as DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and stablecoins. This way, if one sector experiences downturns, others may still perform well.

- Geographical Diversity: Explore cryptocurrencies that originate from different countries or regions. This can help mitigate risks related to regulatory changes in any one jurisdiction.

Implementing these risk management strategies can help cryptocurrency investors navigate the inherent volatility of the market, making informed decisions that protect their investments while capitalizing on potential gains.

Tools and Resources for Managing Crypto Volatility

In the ever-evolving landscape of cryptocurrency, managing volatility is crucial for investors aiming to navigate the market effectively. With the right tools and resources, you can make informed decisions that mitigate risks associated with sudden price swings. This segment will highlight essential tools for real-time data, market analysis, and educational resources to enhance your trading skills.

Real-Time Data and Market Analysis Tools

To stay ahead in the cryptocurrency market, utilizing tools that provide real-time data and market analysis is essential. These tools offer insights into price movements, trading volumes, and market sentiment. Here are some popular platforms that cater to these needs:

- CoinMarketCap: A comprehensive resource for tracking cryptocurrency prices, market capitalization, trading volume, and historical data.

- TradingView: An advanced charting platform that provides real-time market data, technical analysis tools, and social networking features for traders.

- CoinGecko: Offers price tracking and fundamental analysis of the crypto market, along with insights into community engagement.

- CryptoCompare: Provides detailed data on cryptocurrency prices, charts, and portfolio management tools.

Learning Resources for Technical Analysis

Understanding technical analysis is vital for making sound trading decisions in the volatile crypto market. Here’s a selection of resources that can help you hone your technical analysis skills:

- Investopedia: Offers a wealth of articles and tutorials on technical analysis concepts and strategies specific to cryptocurrencies.

- CryptoCred: A popular YouTube channel dedicated to technical analysis and trading strategies for cryptocurrencies.

- Books like “Technical Analysis of the Financial Markets” by John Murphy: Provides foundational knowledge applicable to crypto trading.

Popular Portfolio Management Platforms

Managing your cryptocurrency portfolio effectively is key to navigating market volatility. Here’s a list of well-regarded platforms that assist in portfolio management:

- Blockfolio: A mobile app that allows users to track their cryptocurrency investments and receive price alerts.

- Delta: An intuitive portfolio tracker that provides insights into your investments and market performance.

- CoinStats: A comprehensive portfolio management tool that aggregates data from various exchanges and wallets.

- Cryptocompare Portfolio: Helps you to manage, track, and analyze your investments in real time.

Long-term vs. Short-term Trading Strategies

Source: sabguthrie.info

In the world of cryptocurrency, investors often grapple with the decision of whether to adopt a long-term holding approach or engage in short-term trading. Each strategy offers distinct advantages and challenges, and understanding these nuances is crucial for making informed investment decisions. This section will delve into the fundamental differences between long-term and short-term strategies, illustrating their potential returns and the psychological implications that accompany each approach.

Differences Between Long-term and Short-term Strategies

Long-term holding, often referred to as ‘HODLing,’ involves purchasing cryptocurrency with the intent to hold onto it for an extended period, typically years. This strategy relies on the belief that the asset will appreciate significantly over time despite short-term volatility. Conversely, short-term trading, which may involve day trading or swing trading, focuses on capitalizing on market fluctuations and price movements over shorter time frames, often within days or weeks.The potential returns for each strategy can vary significantly due to market dynamics.

For example, a long-term strategy might yield substantial returns during a bull market, where an investor holds Bitcoin from $10,000 to $100,000 over three years. In contrast, a short-term trader might buy and sell Bitcoin multiple times, potentially capitalizing on price swings between $10,000 and $15,000 within a few weeks. To illustrate the potential returns of each strategy, consider the following hypothetical scenario over a five-year period:

| Strategy | Initial Investment | Final Value (after 5 years) | Projected Return |

|---|---|---|---|

| Long-term Holding | $1,000 | $10,000 | 1,000% Return |

| Short-term Trading | $1,000 | $5,000 | 500% Return |

This table showcases the potential for higher returns through long-term holding, although short-term trading can yield significant gains as well, depending on market conditions and trading skills.

Psychological Implications of Trading Strategies

The psychological landscape of investing in cryptocurrency varies dramatically between long-term holders and short-term traders. Long-term investors often exhibit a mindset characterized by patience and a focus on future potential, which can lead to a more stable emotional state amid market fluctuations. They tend to be less reactive to daily price changes, allowing them to avoid the stress of constant monitoring.In contrast, short-term traders must navigate a more turbulent emotional environment.

The frequent buying and selling can lead to heightened stress and anxiety, particularly during volatile market conditions. The need for quick decision-making and constant engagement with the market can induce feelings of excitement but also fear of missing out (FOMO) or fear of loss, which can cloud judgment.Understanding these psychological factors is essential for investors as they develop their strategies.

Adopting a long-term perspective may encourage greater resilience against market volatility, while short-term trading may require robust emotional control and disciplined risk management.

“Successful trading is not about being right all the time; it’s about managing risk and emotions effectively.”

Closing Notes: Why Crypto Is Volatile And How To Manage It

In conclusion, navigating the volatility of cryptocurrency requires a blend of knowledge, strategy, and emotional intelligence. By recognizing the factors that contribute to price swings and employing effective risk management techniques, investors can better position themselves in this dynamic market. Embracing both long-term and short-term strategies will not only enhance one’s trading experience but also build resilience against the unpredictable nature of digital assets.

FAQ Summary

What causes volatility in cryptocurrency?

Volatility in cryptocurrency is primarily driven by market sentiment, regulatory news, technological developments, and the overall supply and demand dynamics.

How can I manage risks in crypto trading?

Implementing risk management strategies such as setting stop-loss orders, diversifying your portfolio, and regularly reviewing market conditions can help mitigate risks.

Is crypto volatility a good or bad thing?

While volatility can present opportunities for significant gains, it also increases the risk of substantial losses, making it crucial to approach crypto investments with a clear strategy.

How does investor psychology affect crypto markets?

Investor psychology plays a significant role in crypto markets, as emotions like fear and greed can lead to irrational trading decisions that amplify price volatility.

What tools can help track crypto market volatility?

Tools like real-time data trackers, technical analysis software, and portfolio management platforms can assist investors in monitoring and managing market volatility effectively.