The Role of Smart Contracts in Web3 Unleashed

The Role of Smart Contracts in Web3 takes center stage as we dive into a transformative aspect of the digital landscape. Smart contracts, self-executing contracts with the terms directly written into code, have revolutionized how agreements are made and enforced. Originating from blockchain technology, they eliminate the need for intermediaries, offering speed, transparency, and security. Various industries, from finance to supply chain management, harness the power of smart contracts to streamline processes and enhance efficiency.

This exploration will cover the technical framework supporting smart contracts, their significant contribution to the decentralization of Web3, and fascinating use cases that showcase their potential. Despite their advantages, we’ll also address the challenges and limitations that accompany smart contract implementation, along with future trends that may shape their evolution.

Introduction to Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They originated from the work of computer scientist Nick Szabo in the 1990s, who envisioned a decentralized solution for legal agreements that could operate without the need for intermediaries. Over the years, the rise of blockchain technology provided the perfect foundation for these contracts to thrive, allowing for automated processes that enhance trust and security.Smart contracts are being utilized across various industries, demonstrating their versatility and efficiency.

For instance, in the finance sector, they are used for automating loan agreements and facilitating decentralized finance (DeFi) applications. In the real estate industry, smart contracts simplify property transfers, allowing parties to buy and sell properties securely without the need for extensive paperwork. The supply chain sector also benefits from smart contracts by enabling real-time tracking of goods and automating payments based on delivery confirmations.

Advantages Over Traditional Contracts

The adoption of smart contracts offers numerous benefits compared to traditional contracts. By understanding these advantages, businesses and individuals can leverage the technology to streamline operations.

- Automation: Smart contracts automatically execute actions when predefined conditions are met, reducing the need for manual intervention.

- Transparency: All transactions are recorded on the blockchain, ensuring that all parties have access to the same information, thereby enhancing trust.

- Cost Efficiency: Eliminating intermediaries reduces administrative costs and legal fees associated with traditional contract management.

- Speed: Transactions are processed in real-time, significantly speeding up processes that could take days or weeks with traditional contracts.

- Security: Blockchain technology provides a secure environment that is resistant to tampering and fraud, making smart contracts highly reliable.

The efficiency of smart contracts can lead to significant reductions in time and cost, transforming the way businesses interact and transact.

The Technical Framework of Smart Contracts

Source: storicamente.org

The technical architecture behind smart contracts plays a crucial role in their functionality and reliability. This framework is primarily built on blockchain technology, which ensures transparency and security in executing contract terms automatically. Smart contracts are essentially self-executing contracts with the agreement terms written directly into code. They operate on decentralized networks, leveraging blockchain to provide a tamper-proof environment. This means that once deployed, a smart contract cannot be altered, ensuring trust among parties involved.

The following sections delve into the coding languages, components, and functions that define smart contracts.

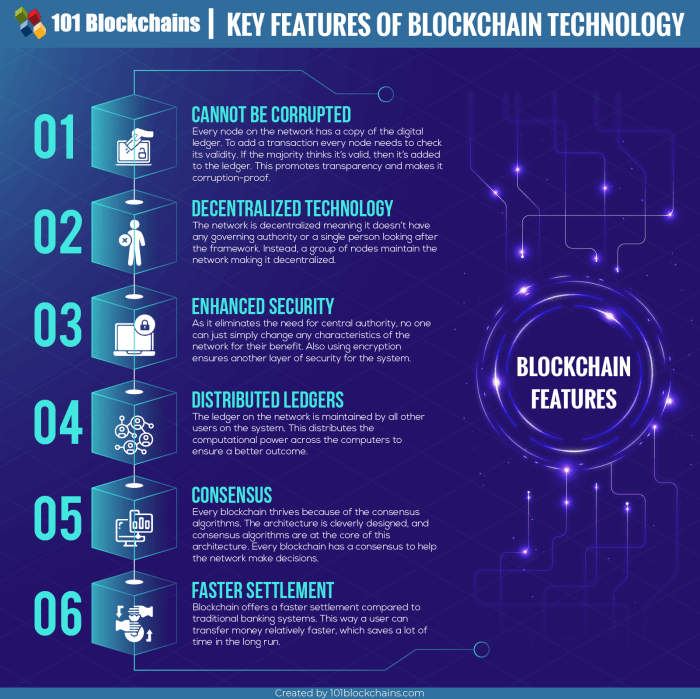

Underlying Technology: Blockchain

Blockchain technology is the backbone of smart contracts, providing a decentralized ledger that records all transactions across a network of computers. This decentralized nature eliminates the need for intermediaries, reducing costs and speeding up processes. Each block in the chain contains a cryptographic hash of the previous block, ensuring data integrity and security.Key characteristics of blockchain that enhance smart contract functionality include:

- Decentralization: By distributing the database across multiple nodes, no single entity has control, reducing risks associated with central authorities.

- Immutability: Once recorded on the blockchain, data cannot be altered or deleted, ensuring a permanent and verifiable record.

- Transparency: All transactions are visible to participants, promoting trust and accountability.

- Security: Advanced cryptographic techniques protect data against unauthorized access and cyber threats.

Coding Languages for Smart Contracts

The development of smart contracts often employs specific programming languages tailored for blockchain environments. The most prominent of these include:

- Solidity: This high-level language is primarily used on the Ethereum blockchain for writing smart contracts. Its syntax resembles JavaScript, making it accessible for developers familiar with web development.

- Vyper: Another language used for Ethereum, Vyper emphasizes security and simplicity, making it suitable for developers who prioritize code clarity.

- Rust: Known for its performance and safety, Rust is gaining traction for smart contracts on platforms like Polkadot and Solana.

- Chaincode: Utilized within Hyperledger Fabric, Chaincode allows for the creation of smart contracts in a modular and scalable environment, ideal for enterprise solutions.

Key Components of a Smart Contract

A smart contract consists of several components, each serving a distinct function that contributes to its overall operation. Understanding these components is crucial for developers and users alike.The main components include:

- Contract Address: Each smart contract is deployed at a unique address on the blockchain, allowing users to interact with it through this identifier.

- Functions: These are the executable parts of the contract that define the actions that can be performed. They can be called by users or triggered by external events.

- State Variables: These store the contract’s data and status, maintaining the contract’s current state between transactions.

- Events: Events allow smart contracts to communicate with external applications. They provide a way to log activity that can be observed by off-chain systems.

Smart Contracts and Decentralization

Source: lucidmanager.org

Smart contracts are a cornerstone of the Web3 ecosystem, facilitating a paradigm shift toward decentralization. They empower users to interact with digital assets and services without the need for intermediaries, enhancing trust and transparency. As we delve into the relationship between smart contracts and decentralization, we will explore how these automated protocols underpin decentralized applications (dApps) and the broader implications for the digital landscape.Smart contracts function as self-executing agreements coded on blockchain platforms, ensuring that the terms are enforced automatically.

This characteristic eliminates the need for centralized authorities, thereby promoting a decentralized architecture. The interplay between smart contracts and decentralized applications is crucial; dApps utilize smart contracts to operate without a central governing entity, allowing users to retain control over their data and transactions.

Decentralized Applications (dApps) and Their Functionality

Decentralized applications rely heavily on smart contracts to deliver seamless user experiences while maintaining decentralization principles. dApps are designed to work across a peer-to-peer network, recording transactions on a blockchain in a transparent manner. Smart contracts serve as the backbone of these applications, enabling functionalities such as token exchanges, gaming, and financial services.The advantages of integrating smart contracts with dApps include:

- Trustless Interactions: Users can engage with services without trusting a central authority, as all actions are governed by code that executes automatically.

- Increased Transparency: Every transaction and interaction is recorded on the blockchain, providing an immutable ledger that anyone can audit.

- Reduced Costs: Eliminating intermediaries reduces transaction fees and improves overall efficiency.

- Global Accessibility: dApps are available to anyone with an internet connection, removing barriers to entry for users worldwide.

Numerous successful decentralized platforms exemplify the power of smart contracts:

1. Ethereum

The leading blockchain for smart contracts, Ethereum hosts thousands of dApps across various sectors such as finance, gaming, and supply chain management. Its robust ecosystem has fostered innovation and collaboration among developers.

2. Uniswap

A decentralized exchange that utilizes automated smart contracts for trading cryptocurrencies without the need for a centralized order book. This model allows users to trade directly from their wallets, ensuring full control over their assets.

3. Aave

A decentralized lending platform that allows users to lend and borrow cryptocurrencies using smart contracts. Aave’s unique approach enables users to earn interest on their deposits or take out loans without traditional financial institutions.

4. Chainlink

By providing reliable oracles, Chainlink connects smart contracts to real-world data, enhancing their functionality and enabling use cases that require external inputs, such as price feeds.

Smart contracts are revolutionizing how we think about trust, transparency, and efficiency in the digital economy.

Use Cases of Smart Contracts in Web3

Source: postshift.com

Smart contracts are transforming various industries by providing automated, secure, and transparent solutions that enhance efficiency and reduce costs. Their ability to execute predefined actions when certain conditions are met makes them ideal for a multitude of applications. Below, we explore some significant use cases in finance, supply chain management, and the realm of non-fungible tokens (NFTs) and digital ownership.

Smart Contracts in Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is one of the most prominent applications of smart contracts, enabling financial services without traditional intermediaries. These contracts facilitate various financial operations like lending, borrowing, trading, and yield farming.

- Lending Platforms: Protocols such as Aave and Compound use smart contracts to allow users to lend and borrow assets. Users can earn interest on their deposits, while borrowers can access funds quickly and without lengthy approval processes.

- Automated Market Makers (AMMs): Uniswap, a leading decentralized exchange, leverages smart contracts to facilitate trading between cryptocurrencies. Users provide liquidity via smart contracts and earn fees while trades are automatically executed based on real-time market conditions.

- Yield Farming: Platforms like Yearn.finance use smart contracts to automate the process of optimizing yield, allowing users to maximize returns on their investments with minimal manual intervention.

Smart Contracts in Supply Chain Management

In supply chain management, smart contracts enhance transparency, traceability, and efficiency by automating processes and ensuring compliance with contractual obligations. They help track the provenance of goods and manage logistics seamlessly.

- Provenance Tracking: Companies like IBM and Walmart employ smart contracts to trace the origin of products. For example, a smart contract can log each step of the supply chain, from production to delivery, allowing consumers to verify the authenticity and ethical sourcing of products.

- Automated Payments: Smart contracts streamline payments in supply chains. When goods are delivered and verified against the terms of the contract, payment is automatically released to the supplier, which minimizes delays and improves cash flow.

- Compliance Monitoring: Smart contracts can be programmed to ensure that all parties adhere to regulatory requirements. For instance, they can automatically trigger audits or penalties if conditions are not met, promoting accountability among stakeholders.

Smart Contracts in NFTs and Digital Ownership

The emergence of non-fungible tokens (NFTs) has revolutionized digital ownership, with smart contracts playing a crucial role in verifying authenticity and transferring ownership rights.

- Ownership Verification: Each NFT is linked to a unique smart contract that verifies the ownership and scarcity of the digital asset. This ensures that buyers can trust the provenance and legitimacy of their purchases.

- Royalties and Resale: Smart contracts allow creators to earn royalties automatically whenever an NFT is resold. For example, a musician selling an NFT of their music can set a percentage of the resale price to be sent back to them, ensuring ongoing revenue from their work.

- Fractional Ownership: Smart contracts enable the fractionalization of NFTs, allowing multiple users to own a share of a high-value asset. This opens up new investment opportunities, making it easier for individuals to participate in the ownership of expensive digital art or collectibles.

Challenges and Limitations of Smart Contracts

Smart contracts, while revolutionary and offering numerous advantages, also face a variety of challenges and limitations that can hinder their widespread adoption and effectiveness. Understanding these challenges is crucial for developers, businesses, and users who seek to utilize smart contracts within the Web3 ecosystem. From technical issues to legal implications, each facet plays a significant role in the practical application of smart contracts.

Common Risks Associated with Smart Contracts

Smart contracts are not without risks, which can arise from various factors including coding errors, vulnerabilities, and human oversight. The complexity of smart contracts can lead to unforeseen issues that may not be identified until it is too late. Here are some common risks:

- Code Vulnerabilities: Bugs or flaws in the smart contract code can be exploited, leading to unauthorized access or losses. The infamous DAO hack is a notable example, where a vulnerability allowed an attacker to drain millions of dollars worth of Ether.

- Immutability Issues: Once deployed, smart contracts cannot be easily altered. This immutability can be a double-edged sword; while it guarantees trust, it also means that if a bug is discovered, fixing it can be extremely difficult and may require deploying a new contract.

- Dependency on External Data: Smart contracts often rely on oracles for real-world data. If the oracle provides inaccurate information, it can lead to incorrect contract execution.

Legal Implications and Regulatory Challenges

The legal landscape surrounding smart contracts remains uncertain and varies significantly from jurisdiction to jurisdiction. Many legal systems are still grappling with how to approach digital contracts, leading to various regulatory challenges. Important points include:

- Contract Validity: There is ongoing debate regarding whether smart contracts can be considered legally binding under existing laws, raising questions about their enforceability in courts.

- Regulatory Compliance: Businesses using smart contracts must navigate complex regulations related to data protection, anti-money laundering, and securities laws, which can complicate their implementation.

- Dispute Resolution: The lack of established frameworks for resolving disputes related to smart contracts can pose a challenge, as traditional legal mechanisms may not be suitable for digital environments.

Scalability and Interoperability Issues

Scalability and interoperability are key technical challenges that can limit the effectiveness of smart contracts across various blockchain platforms. These issues must be addressed to enhance the utility of smart contracts in a rapidly evolving digital landscape. Key considerations include:

- Network Congestion: High transaction volumes can lead to network congestion, resulting in slower processing times and increased transaction fees, as seen during peak activity on networks like Ethereum.

- Cross-Chain Compatibility: Many smart contracts are restricted to their native blockchain, making it difficult for them to interact with other chains. This lack of interoperability can limit their use cases and hinder broader adoption.

- Resource Limitations: Smart contracts often require significant computational resources, which can lead to excessive costs and inefficiencies, particularly on networks with high transaction fees.

Future Trends in Smart Contracts

As we look ahead to the evolution of smart contracts within the Web3 ecosystem, it becomes evident that these self-executing agreements will undergo significant advancements. The combination of evolving technologies, increased adoption, and a growing diversity of applications suggests that we are just scratching the surface of what smart contracts can achieve.One of the most pivotal areas for development is the integration of artificial intelligence (AI) with smart contracts.

AI can enhance the decision-making capabilities of smart contracts by allowing them to analyze vast amounts of data and make autonomous decisions based on predefined parameters. This could lead to more dynamic contracts that adapt to changing conditions in real-time, creating immense value across various sectors.

Integration of AI and Machine Learning

The incorporation of AI and machine learning technologies into smart contracts will revolutionize their functionality. By harnessing these technologies, smart contracts can become self-learning systems that improve efficiency and reduce errors. This integration will likely enable advanced features, such as predictive analytics and automated compliance checks, further enhancing trust and reliability in contract execution.For example, imagine a smart contract in the insurance industry that uses AI to assess risk factors and automatically adjust premiums based on real-time data analysis, such as weather patterns or health statistics.

This ability to react promptly to external conditions can streamline processes and reduce fraud.

Blockchain Interoperability Solutions, The Role of Smart Contracts in Web3

Interoperability among various blockchain platforms is crucial for the widespread adoption of smart contracts. Future developments will likely focus on creating seamless connections between different blockchains, allowing smart contracts to interact with each other across platforms. This will enhance the versatility and usability of smart contracts, enabling them to serve more complex use cases.Such interoperability can foster collaboration among organizations and industries, leading to innovative solutions.

For instance, a smart contract deployed on one blockchain could automatically trigger actions on another, facilitating efficient supply chain operations or cross-border transactions.

Expansion Across Sectors

Smart contracts are set to have a profound impact across various sectors, including finance, healthcare, real estate, and logistics. Their ability to automate processes and ensure transparency can address inefficiencies and reduce costs.In the finance sector, decentralized finance (DeFi) will continue to grow, where smart contracts can facilitate complex financial transactions without intermediaries. In healthcare, smart contracts can ensure secure patient data sharing while maintaining privacy, enabling better coordination among healthcare providers.

Real estate transactions can be simplified through smart contracts that automate the transfer of property ownership upon payment, eliminating the need for lengthy procedures.

Smart contracts are positioned to disrupt traditional industries by providing a more efficient, transparent, and secure approach to transactions.

As we move forward, we can expect smart contracts to evolve into more sophisticated tools that harness emerging technologies, redefine existing systems, and create new business models. Their potential to revolutionize how we conduct transactions and interact with each other is limitless, marking the dawn of a new era in the Web3 landscape.

Best Practices for Developing Smart Contracts: The Role Of Smart Contracts In Web3

In the rapidly evolving landscape of Web3, crafting secure and efficient smart contracts is crucial for their successful deployment and operation. As these contracts are essentially self-executing agreements with the terms directly written into code, adhering to best practices can mitigate risks and enhance functionality. This section Artikels essential guidelines for developers to follow throughout the smart contract development process.

Guidelines for Writing Secure Smart Contracts

Creating secure smart contracts involves a thoughtful approach to coding and design. Following best practices helps in minimizing vulnerabilities that could lead to costly exploits. Key guidelines include:

- Keep It Simple: Aim for simplicity in your code to reduce potential errors. Complex logic can lead to unexpected behaviors and vulnerabilities.

- Use Established Patterns: Leverage well-known design patterns, such as the checks-effects-interactions pattern, to enhance security and maintainability.

- Variables Visibility: Properly manage the visibility of variables. Use

privateorinternals when necessary to safeguard sensitive data. - Limit Gas Usage: Optimize functions to minimize gas consumption. High gas fees can deter users and stress the network.

Importance of Testing and Auditing Smart Contracts

Thorough testing and auditing are vital for ensuring the security and reliability of smart contracts prior to deployment. Skipping these steps can lead to severe consequences, including financial losses and reputational damage. Here are points to consider:

- Unit Testing: Implement comprehensive unit tests that cover all functionalities of the contract. Aim for high code coverage to identify edge cases.

- Integration Testing: Test interactions between multiple smart contracts to ensure they work seamlessly together in a live environment.

- Code Audits: Engage third-party auditors to review the code. Their fresh perspective can reveal vulnerabilities that the original developers may have overlooked.

- Testnets: Deploy contracts on testnets to simulate real-world scenarios without risking real assets. This allows for trial runs and adjustments before mainnet deployment.

Resources and Tools for Smart Contract Development

Developers have access to a range of resources and tools designed to streamline the smart contract development process. Utilizing these can enhance productivity and reduce the likelihood of errors:

- Solidity Documentation: The official Solidity documentation provides detailed guidance on syntax, features, and best practices for writing smart contracts.

- Remix IDE: This web-based IDE is an excellent tool for developing, testing, and debugging smart contracts in Solidity.

- Truffle Suite: A development framework that provides tools for compiling, testing, and deploying smart contracts with ease.

- MythX: An advanced security analysis tool that helps identify vulnerabilities in smart contracts before they are deployed.

Wrap-Up

In summary, the discussion around The Role of Smart Contracts in Web3 highlights their immense potential to redefine industries and empower decentralized applications. While smart contracts bring forth remarkable advantages, it is crucial to remain aware of the inherent risks and challenges. As we look ahead, the integration of emerging technologies will likely enhance their functionality and impact, paving the way for innovations that could further reshape the digital ecosystem.

Top FAQs

What are smart contracts?

Smart contracts are self-executing contracts with the terms of the agreement directly written into code, enabling automatic execution when predefined conditions are met.

How do smart contracts differ from traditional contracts?

Unlike traditional contracts that require intermediaries for enforcement, smart contracts operate on blockchain technology, ensuring trust and transparency without third-party involvement.

What industries are using smart contracts?

Smart contracts are utilized in various sectors, including finance (DeFi), real estate, supply chain management, and digital ownership through NFTs.

What are some common risks associated with smart contracts?

Common risks include coding errors, security vulnerabilities, and potential legal ambiguities that can arise from untested or poorly written contracts.

What is the future of smart contracts in Web3?

The future of smart contracts involves advancements in scalability, interoperability, and integration with emerging technologies, enhancing their application across multiple sectors.