Cryptocurrency Adoption Around the World Insights Unveiled

Cryptocurrency Adoption Around the World sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As digital currencies reshape the global landscape, understanding the nuances of their adoption becomes essential. This exploration covers the surge in cryptocurrency use, highlighting significant statistics and the factors propelling its growth across various regions. From cultural influences to technological advancements, the journey of cryptocurrency is not just about finance; it’s about the evolution of an entire economy.

Overview of Cryptocurrency Adoption

Cryptocurrencies, digital or virtual currencies that use cryptography for security, have transformed the way individuals and businesses engage in financial transactions. Their decentralized nature, facilitated by blockchain technology, empowers users by eliminating the need for intermediaries like banks. This revolutionary shift not only enhances transaction efficiency but also significantly impacts the global economy by providing financial inclusion to unbanked populations and fostering innovation in various sectors.In recent years, global cryptocurrency usage has surged dramatically.

A report from Chainalysis highlights that over 300 million people worldwide were using cryptocurrency as of late 2021, a figure that has likely grown since. According to Statista, as of 2023, there are approximately 420 million cryptocurrency users globally, indicating a robust growth trend. Ownership varies significantly by region, with countries like Nigeria and Vietnam leading in adoption rates, driven by a combination of economic necessity and technological accessibility.

Major Factors Driving Cryptocurrency Adoption

Several key factors contribute to the increasing adoption of cryptocurrencies across different regions. Understanding these factors provides insight into the varied landscape of cryptocurrency acceptance and utilization globally.

- Economic Instability: In countries facing hyperinflation or political turmoil, cryptocurrencies offer a stable alternative to local currencies. For instance, Venezuela has seen a significant uptick in Bitcoin transactions as residents seek to preserve their wealth amidst economic collapse.

- Technological Advancement: The rise of mobile internet access and smartphone usage facilitates easier engagement with cryptocurrencies. Regions like Southeast Asia, where mobile wallets are prevalent, have witnessed rapid cryptocurrency adoption as users leverage technology for financial transactions.

- Investment Opportunities: The potential for high returns has attracted investors worldwide, with institutions increasingly allocating funds to cryptocurrencies. In 2021, major companies like Tesla and Square announced substantial Bitcoin investments, further legitimizing its status as a viable asset class.

- Regulatory Developments: As governments establish clearer regulatory frameworks, confidence in cryptocurrencies grows. Countries such as El Salvador have even adopted Bitcoin as legal tender, paving the way for broader acceptance and usage.

- Peer-to-Peer Transactions: The ability to transact directly with others without intermediaries appeals to many users. This is particularly important in regions with limited access to traditional banking services, where individuals rely on cryptocurrencies for everyday transactions.

“Cryptocurrencies serve as a gateway to financial inclusion, allowing people to participate in the global economy with just a smartphone.”

Regional Adoption Trends

Source: wallpaperaccess.com

The global landscape of cryptocurrency adoption is diverse, demonstrating unique trends and patterns across various regions. As technological advances continue to reshape financial systems, certain countries have emerged as leaders, fostering environments conducive to embracing digital currencies. By examining these trends, we can gain insights into how cultural, economic, and political factors mold the cryptocurrency landscape worldwide.Different regions exhibit distinct adoption rates influenced by local circumstances, such as financial regulations, access to technology, and public perception of digital currencies.

Countries like Nigeria, Vietnam, and the United States are at the forefront, reflecting varying degrees of enthusiasm and acceptance regarding cryptocurrencies.

Leading Countries and Adoption Rates

Understanding the leading countries in cryptocurrency adoption offers a glimpse into the factors driving their success. Here are some notable examples along with their respective adoption rates:

- Nigeria: Approximately 35% of the population engages in cryptocurrency activities. This high rate is driven by economic instability and inflation, prompting individuals to seek alternative financial solutions.

- Vietnam: Reports indicate an adoption rate of about 21%. The younger demographic in Vietnam is particularly open to cryptocurrencies, viewing them as an investment and a means of remittance.

- United States: With an estimated adoption rate of 14%, the U.S. boasts a strong technological infrastructure and a growing acceptance of cryptocurrencies among institutional investors.

- India: Approximately 7% of the population participates in cryptocurrency transactions, influenced by aspirations for financial inclusion amidst a cash-heavy economy.

The varying rates highlight the impact of national narratives surrounding finance and technology.

Factors Influencing Cryptocurrency Use by Region

Cultural, economic, and political factors significantly impact cryptocurrency adoption across different regions. Here are some key influences:

- Cultural openness: Countries with a younger population tend to adopt cryptocurrencies more readily, driven by a tech-savvy mindset that embraces innovation.

- Economic necessity: In regions facing hyperinflation or economic instability, like Venezuela and Nigeria, cryptocurrencies provide an alternative to collapsing fiat currencies.

- Regulatory environment: Countries with clear regulations, such as Switzerland, encourage investment by providing a stable legal framework for cryptocurrency operations.

- Technological infrastructure: Regions with advanced internet connectivity and smartphone penetration, such as Southeast Asia, facilitate easier access to cryptocurrency platforms.

Each of these factors plays a crucial role in shaping how cryptocurrencies are perceived and utilized in various contexts.

Cryptocurrency Adoption Rates by Continent

The following table summarizes the cryptocurrency adoption rates across different continents, illustrating the global disparities in engagement with digital currencies:

| Continent | Adoption Rate (%) |

|---|---|

| Africa | 13.5 |

| Asia | 15.5 |

| Europe | 9.8 |

| North America | 10.3 |

| Oceania | 8.6 |

| South America | 12.2 |

This table highlights how different regions are navigating the world of cryptocurrency, reflecting varied levels of interest and investment that are essential for understanding global adoption trends.

Regulatory Frameworks and Their Impact: Cryptocurrency Adoption Around The World

The regulatory environment surrounding cryptocurrency is a significant factor influencing its adoption across the globe. Different countries have adopted varying approaches to regulation, reflecting their unique economic, cultural, and political contexts. These regulations can either encourage innovation and investment in the cryptocurrency space or create barriers that stifle growth and limit participation.The impact of regulations on cryptocurrency adoption is multifaceted.

In some regions, clear and supportive regulatory frameworks have fostered growth, while in others, uncertainty or restrictive measures have deterred participation. Understanding these dynamics is crucial for assessing the global landscape of cryptocurrency adoption.

Global Regulatory Approaches to Cryptocurrency

The regulatory approaches to cryptocurrency differ significantly from one country to another. Here’s a look at some of the prominent examples:

- United States: The U.S. has a patchwork of regulations, with individual states implementing their own laws. The SEC classifies some cryptocurrencies as securities, which subjects them to strict regulations. This duality creates both opportunities and challenges for adoption.

- European Union: The EU is moving towards unified regulations with frameworks like MiCA (Markets in Crypto-Assets), aiming to provide clarity while also promoting innovation. This is seen as a positive step towards broader adoption.

- China: China has adopted a restrictive approach, banning initial coin offerings (ICOs) and cryptocurrency trading. However, the country is simultaneously investing heavily in blockchain technology, showing a complex relationship with digital currencies.

- Japan: Japan has embraced cryptocurrency, implementing regulations that require exchanges to register and comply with anti-money laundering (AML) standards. This has established a level of trust and security in the market, promoting wider adoption.

- El Salvador: El Salvador has made history by adopting Bitcoin as legal tender, signaling a radical approach towards cryptocurrency that aims to boost financial inclusion in the country.

Regulatory policies can greatly influence the environment for cryptocurrency innovation and usage. Countries with proactive regulatory stances tend to attract investment and foster technological advancements, while those with restrictive measures often see a decline in market activity.

“Regulatory clarity can be a beacon for institutional investors and can ultimately lead to increased adoption rates.”

In summary, the regulatory frameworks governing cryptocurrencies are crucial in shaping how these digital assets are perceived and utilized in different regions. The balance between regulation and innovation will continue to play a pivotal role in the future of cryptocurrency adoption worldwide.

Education and Awareness Initiatives

Educational programs play a pivotal role in demystifying cryptocurrencies and promoting their adoption across various demographics. As the cryptocurrency landscape evolves, the need for informed individuals who understand the technology and its potential benefits becomes increasingly crucial. By enhancing public understanding, these initiatives can reduce skepticism and foster a more inclusive financial ecosystem.One of the most effective ways to build awareness around cryptocurrencies is through targeted educational campaigns.

Successful initiatives have been launched globally, emphasizing the importance of understanding digital currencies, their underlying technology, and their potential impact on the financial system. For instance, organizations like the Blockchain Education Network (BEN) and various universities have developed courses and workshops that cater to both beginners and advanced learners. These programs typically cover fundamental concepts, practical use cases, and security measures involved in cryptocurrency transactions.

Examples of Successful Campaigns

Several campaigns have made significant strides in increasing public awareness of cryptocurrencies. Notable examples include:

- Bitcoin 101 Workshops: Organized by local community centers and universities, these workshops provide hands-on learning experiences where participants can understand Bitcoin mechanics, how to acquire it, and its uses.

- Cryptocurrency for Kids: Initiatives aimed at younger audiences, such as educational games and simulations, help introduce children to the concepts of digital currencies and blockchain technology in a fun and engaging way.

- Online Webinars and Courses: Platforms like Coursera and Udemy offer comprehensive courses on blockchain technology and cryptocurrency, enabling learners worldwide to access valuable knowledge at their own pace.

Community Outreach Program Framework

Creating a community outreach program dedicated to cryptocurrency education involves several key components. A structured framework ensures that the initiative reaches its intended audience effectively.

1. Needs Assessment

Conduct surveys or focus groups to identify the community’s existing knowledge level about cryptocurrencies and their specific interests or concerns.

2. Curriculum Development

Design an engaging curriculum that includes topics such as the basics of blockchain, wallet security, practical applications of cryptocurrencies, and the legal landscape. The curriculum should be adaptable to cater to diverse age groups and knowledge levels.

3. Partnerships

Collaborate with local businesses, educational institutions, and non-profit organizations to leverage resources, expertise, and networks for broader outreach.

4. Delivery Methods

Utilize a mix of in-person workshops, online webinars, and informational resources like pamphlets or newsletters to cater to different learning preferences.

5. Feedback Mechanism

Implement a system for participants to provide feedback, allowing for continuous improvement of the program based on community needs.

6. Follow-Up Initiatives

Organize regular follow-up events, discussions, or news updates to keep the community engaged and informed about the rapidly changing cryptocurrency landscape.This structured approach can help demystify cryptocurrency for the public, making it more accessible and fostering a generation of informed users who can responsibly participate in the evolving digital economy.

Technological Infrastructure

Source: wixstatic.com

The role of technological infrastructure is pivotal in fostering the growth and adoption of cryptocurrencies globally. A robust technological backbone enables seamless and secure transactions, which is crucial for user trust and engagement. As the cryptocurrency market continues to evolve, understanding the underlying technologies and their implications for adoption becomes increasingly important.Advanced technological infrastructures, such as blockchain technology and mobile wallets, serve as the foundation for cryptocurrency transactions.

Blockchain technology ensures transparency and security by creating a decentralized ledger that records all transactions, thus preventing fraud and promoting trust among users. Meanwhile, mobile wallets facilitate easy access and use of cryptocurrencies, allowing users to make transactions on-the-go, which is crucial in today’s fast-paced digital world.

Key Technologies Supporting Cryptocurrency Adoption

Several key technologies play a significant role in supporting the infrastructure necessary for cryptocurrency adoption. Understanding these technologies is essential for recognizing how they contribute to the overall ecosystem.

- Blockchain Technology: This decentralized ledger technology is the backbone of cryptocurrencies. It enables secure, transparent, and immutable transaction records, fostering trust among users.

- Mobile Wallets: These applications allow users to store and manage their cryptocurrencies conveniently from their smartphones, facilitating everyday transactions.

- Smart Contracts: These self-executing contracts with the terms of the agreement directly written into code automate processes and enhance trust, reducing the need for intermediaries.

- Decentralized Finance (DeFi): DeFi platforms leverage blockchain technology to provide financial services without traditional intermediaries, expanding access to financial products.

- Payment Gateways: These services enable businesses to accept cryptocurrency payments, fostering wider acceptance in the retail sector.

Development of Technological Infrastructure by Region

The technological infrastructure for cryptocurrency varies significantly across different regions of the world. The table below Artikels the current state of technological development in key regions, highlighting the advancements made and the challenges faced.

| Region | Technological Advancements | Challenges |

|---|---|---|

| North America | High blockchain adoption; well-established mobile wallet services. | Regulatory uncertainty; concerns over security. |

| Europe | Strong support from financial institutions; advanced payment gateways. | Diverse regulations across countries; varying levels of public awareness. |

| Asia | Rapid growth in DeFi; significant investments in blockchain startups. | Volatile regulatory landscape; high competition among platforms. |

| Africa | Increasing mobile wallet usage; innovative solutions for unbanked populations. | Limited internet access; lack of infrastructure in rural areas. |

| Latin America | Growing acceptance of cryptocurrencies for remittances; emerging blockchain projects. | High inflation rates affecting currency stability; regulatory hurdles. |

Challenges to Adoption

Source: arcpublishing.com

The journey towards widespread cryptocurrency adoption is fraught with various challenges that can hinder its growth and acceptance around the globe. Understanding these barriers is crucial for stakeholders looking to promote and facilitate the adoption process. The following sections delve into the primary challenges faced and provide insights into potential solutions.

Major Barriers to Adoption

Several key challenges affect the adoption of cryptocurrencies worldwide. These include security concerns, volatility in prices, and a general lack of trust among potential users. Each of these factors can deter individuals and businesses from engaging with cryptocurrencies.

- Security Concerns: The decentralized nature of cryptocurrencies, while providing certain advantages, also raises security issues. The risk of hacks, scams, and loss of funds can deter potential users who are wary of entering an unfamiliar digital ecosystem. For instance, high-profile exchange hacks have led to significant financial losses, resulting in skepticism about the safety of investing in cryptocurrencies.

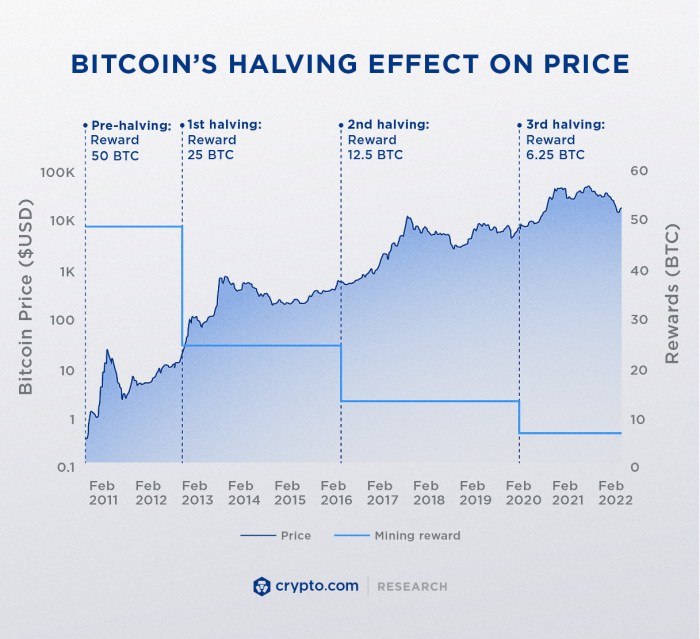

- Volatility: Cryptocurrency markets are known for their price fluctuations, which can be dramatic and unpredictable. This volatility can create uncertainty for investors and users alike, making it challenging to use cryptocurrencies as a stable medium of exchange. For example, Bitcoin has experienced swings of over 20% in a single day, which can dissuade merchants from accepting it as a form of payment.

- Lack of Trust: Trust is a critical component of any financial system. Many potential users lack confidence in cryptocurrencies due to the complexities surrounding blockchain technology and the perceived anonymity of transactions. Scandals and fraudulent schemes within the crypto space have further eroded trust. A 2023 survey indicated that over 60% of respondents expressed concerns about the legitimacy of cryptocurrencies.

Addressing the Challenges

To enhance cryptocurrency adoption, it is essential to implement strategies that mitigate the identified barriers. Various approaches can be adopted to foster a more secure and stable environment for users.

- Enhanced Security Measures: Implementing robust security protocols, such as multi-signature wallets and biometric authentication, can significantly reduce the risk of unauthorized access to funds. Companies that prioritize security can build trust among users, reassuring them that their investments are safe.

- Stablecoin Solutions: Leveraging stablecoins, which are pegged to fiat currencies or commodities, can help address volatility issues. By providing a more stable alternative, these cryptocurrencies can facilitate transactions without the fear of sudden price changes. An example is Tether (USDT), which aims to maintain a 1:1 value ratio with the US dollar.

- Education and Awareness Programs: Increasing public awareness about how cryptocurrencies work and their benefits can help build trust. Initiatives led by governments and private organizations focusing on educational campaigns can demystify the technology and encourage more individuals to explore cryptocurrency investments.

Case Studies of Successful Adaptation

Several regions have implemented strategies to overcome challenges and promote cryptocurrency adoption effectively. These case studies illustrate how tailored solutions can lead to increased acceptance and usage.

- El Salvador: In 2021, El Salvador became the first country to adopt Bitcoin as legal tender. The government launched educational campaigns to inform citizens about Bitcoin, alongside initiatives to improve internet access, thus enhancing technological infrastructure. As a result, the number of Bitcoin wallets surged, showcasing a significant increase in adoption.

- Switzerland: Known for its progressive stance on financial technology, Switzerland has established a favorable regulatory environment for cryptocurrencies. By providing clarity in regulations and promoting blockchain technology, the Swiss government has fostered a thriving crypto ecosystem, attracting numerous startups and investments.

- African Countries: Nations like Nigeria and Kenya have witnessed a surge in cryptocurrency use, driven by the need for alternative financial solutions. Peer-to-peer platforms and mobile payment systems have made it easier for individuals to access cryptocurrencies, addressing issues of trust and volatility through established local frameworks.

Future Prospects of Cryptocurrency Adoption

As cryptocurrency continues to make waves in financial markets and everyday transactions, its future prospects present an exciting landscape for investors, consumers, and regulators alike. The rapid evolution of technology, coupled with increasing public interest, suggests that cryptocurrency adoption is poised for significant growth over the next decade. This growth is likely to vary widely between developed and developing nations, influenced by economic factors, regulatory environments, and technological advancements.

Anticipated Growth Trends in Cryptocurrency Adoption, Cryptocurrency Adoption Around the World

The future of cryptocurrency adoption is expected to be characterized by diverse trends across different regions. Developed nations are likely to see a more gradual increase in adoption rates, as established financial systems integrate blockchain technology into their existing infrastructures. However, developing nations may experience more explosive growth due to the lack of legacy financial systems, making cryptocurrencies an attractive alternative for unbanked populations.

To illustrate this potential, here is a projection table highlighting the anticipated cryptocurrency market growth over the next decade:

| Year | Projected Global Market Size (in billion USD) | Expected Growth Rate (%) |

|---|---|---|

| 2024 | 600 | 25% |

| 2025 | 750 | 25% |

| 2026 | 950 | 27% |

| 2027 | 1,200 | 26% |

| 2028 | 1,500 | 25% |

| 2029 | 1,850 | 23% |

| 2030 | 2,300 | 24% |

This projection underscores the significant growth anticipated, particularly as more individuals and businesses begin to embrace cryptocurrency for transactions and investments.

“Countries that embrace cryptocurrency and blockchain technology could see enhanced economic growth and financial inclusion.”

Furthermore, specific regions within developing nations might outperform their developed counterparts. For instance, countries in Africa and Southeast Asia are witnessing a surge in mobile-based financial services, often integrating cryptocurrencies as part of their payment solutions. This trend is primarily driven by a younger demographic eager to leverage technology for economic participation. In contrast, regulatory frameworks in developed nations may initially slow adoption as governments seek to establish clear guidelines for cryptocurrency usage.

However, successful implementation of these regulations can ultimately lead to a more stable environment, encouraging broader adoption in the long term. As cryptocurrencies become more mainstream, the landscape of finance is likely to transform, creating new opportunities for innovation and growth at a global scale. The interplay between technological advancements, public acceptance, and regulatory frameworks will be crucial in shaping the future of cryptocurrency adoption.

Final Wrap-Up

In summary, the future of Cryptocurrency Adoption Around the World holds both promise and challenges. As we observe varying regulatory frameworks, technological innovations, and educational initiatives, it’s clear that the growth of cryptocurrency is a multifaceted phenomenon. With continued efforts to overcome obstacles and enhance understanding, the potential for widespread adoption remains bright, paving the way for a new financial era.

Helpful Answers

What are the main benefits of cryptocurrency?

Cryptocurrency offers benefits such as decentralization, lower transaction fees, and faster international transactions.

How does cryptocurrency impact traditional banking?

Cryptocurrency challenges traditional banking by providing alternatives for transactions and savings, encouraging banks to innovate.

What role does security play in cryptocurrency adoption?

Security is crucial as it affects users’ trust; robust systems and education on safe practices promote increased adoption.

Can cryptocurrency be used for everyday purchases?

Yes, many businesses now accept cryptocurrencies for everyday transactions, enhancing their usability.

What are the most popular cryptocurrencies today?

Bitcoin and Ethereum lead in popularity, but many other cryptocurrencies are gaining traction.