How Halving Events Affect Bitcoin Price and Their Impact

How Halving Events Affect Bitcoin Price is a fascinating topic that dives deep into a crucial aspect of Bitcoin’s economy. Halving events, which occur approximately every four years, play a significant role in shaping Bitcoin’s value by altering its supply dynamics. Understanding the historical context and the mechanisms behind these events can illuminate the intriguing relationship between these occurrences and Bitcoin prices.

As we explore the historical price trends, market sentiment, and the emotional reactions of traders surrounding these pivotal moments, it becomes clear how halving events not only influence investor behavior but also affect the broader cryptocurrency market. With a backdrop of fluctuating prices and mining profitability, the implications of halving events are far-reaching and worthy of close examination.

Understanding Halving Events

Halving events are significant occurrences within the Bitcoin network that play a crucial role in its economic model. They are programmed reductions in the reward that miners receive for validating transactions and adding them to the blockchain. By understanding halving events, one can gain insight into Bitcoin’s scarcity and its potential impact on price dynamics in the cryptocurrency market.Halving events happen approximately every four years, or every 210,000 blocks mined.

The mechanism is integral to Bitcoin’s design, intended to control inflation and ensure a finite supply of the currency. To date, there have been three halving events since Bitcoin’s inception in 2009, each significantly influencing the price and market behavior of Bitcoin.

Historical Timeline of Bitcoin Halving Events

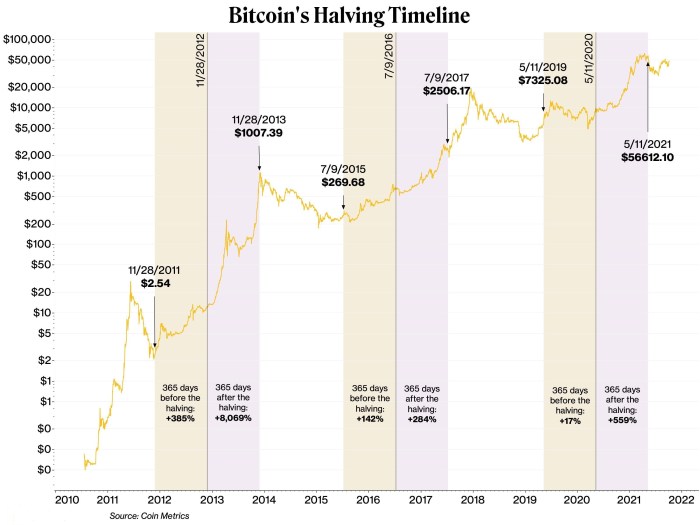

The history of Bitcoin halving events includes notable milestones that have shaped its price trajectory:

1. First Halving – November 2012

The reward for mining Bitcoin reduced from 50 BTC to 25 BTC.

Following this event, Bitcoin’s price surged from around $12 to over $1,000 in the subsequent year.

2. Second Halving – July 2016

The mining reward decreased from 25 BTC to 12.5 BTC.

In the year that followed, Bitcoin saw its price rise from approximately $650 to nearly $20,000 by the end of 2017.

3. Third Halving – May 2020

The most recent halving cut the reward from 12.5 BTC to 6.25 BTC.

This event was followed by an impressive price rally, with Bitcoin reaching an all-time high of over $64,000 in April 2021.

These halving events have historically been followed by substantial price increases, showcasing the relationship between the reduction in supply and demand.

Mechanisms Triggering a Halving Event

The halving mechanism is built into Bitcoin’s code and functions through the following processes:

Block Rewards

Each time a miner successfully adds a new block to the blockchain, they receive a block reward. This reward is halved after every 210,000 blocks, reducing the rate at which new Bitcoins are generated.

Predictable Supply Schedule

Bitcoin has a total supply cap of 21 million coins. The halving events are a vital part of this predetermined issuance schedule, ensuring that the supply is controlled and inflation is minimized.

Difficulty Adjustment

The Bitcoin network adjusts the difficulty of mining approximately every two weeks, ensuring that new blocks are added at a consistent rate of around one block every ten minutes. This adjustment works in conjunction with halving to maintain the intended supply dynamics.These elements create a self-regulating system that contributes to Bitcoin’s status as a deflationary asset, often leading to increased interest and potential price appreciation following each halving event.

Historical Price Trends Post-Halving: How Halving Events Affect Bitcoin Price

The historical price movements of Bitcoin surrounding halving events provide valuable insights into market behavior and investor sentiment. Halving events, which occur approximately every four years, significantly reduce the rate at which new Bitcoins are created, leading to potential changes in supply and demand dynamics that affect pricing. By examining past halvings, we can identify patterns and trends that may inform our understanding of cryptocurrency market fluctuations.In the following section, the analysis focuses on the Bitcoin price movements before and after key halving events.

This includes examining historical data to illustrate the impact of each halving on Bitcoin’s price, highlighting the volatility and significant price shifts around these crucial dates. The table below compiles relevant data for a clearer comparative analysis.

Comparative Analysis of Bitcoin Prices

The table below summarizes the price of Bitcoin just before and after previous halving events. This data offers a clear perspective on how each halving has influenced price movements historically.

| Date | Price Before (USD) | Price After (USD) | Percentage Change (%) |

|---|---|---|---|

| November 28, 2012 | 12.31 | 1,200.00 | 9,746.14 |

| July 9, 2016 | 657.61 | 2,500.00 | 279.66 |

| May 11, 2020 | 8,500.00 | 64,400.00 | 658.82 |

The data shows that each halving event has historically led to substantial price increases in the months following the event. For instance, after the first halving in 2012, Bitcoin’s price skyrocketed from $12.31 to an astonishing $1,200, marking a remarkable percentage change of over 9,700%. Similarly, the second halving in 2016 saw Bitcoin’s price rise from $657.61 to $2,500, while the most recent halving in May 2020 resulted in a leap to $64,400 from $8,500.

“Halving events have repeatedly proven to be catalysts for price surges in Bitcoin’s history.”

The price volatility surrounding halving dates indicates heightened market speculation and investor interest, which often leads to significant shifts in trading volume and market sentiment. Understanding these historical trends can help investors make informed decisions in anticipation of future halvings and other market dynamics.

Market Sentiment and Halving Effects

Market sentiment plays a crucial role leading up to and following Bitcoin halving events, influencing investor behavior and overall market dynamics. When a halving is anticipated, traders and investors often adjust their strategies based on perceived future scarcity and potential price increases. This sentiment can drive speculative trading, contributing to significant price volatility.The impact of media coverage during halving events cannot be overstated.

News outlets, social media, and influential figures in the cryptocurrency space shape public perception and can either amplify or mitigate enthusiasm for Bitcoin. Positive coverage can lead to bullish sentiment, encouraging more investors to enter the market, while negative reports can incite fear and uncertainty, leading to sell-offs.Key indicators that reflect market sentiment around halving events include:

- Trading Volume: Increased trading volume often indicates heightened interest and speculative behavior, reflective of market sentiment.

- Social Media Activity: The volume of discussions and mentions on platforms like Twitter and Reddit can serve as a barometer for public interest and sentiment surrounding the halving.

- Google Trends: Search interest in terms like “Bitcoin halving” can indicate rising public curiosity and potential investor engagement.

- Fear and Greed Index: This metric gauges the emotional state of the market, where extreme fear can lead to lower prices and extreme greed can signal a bubble.

- Sentiment Analysis Tools: Various platforms offer sentiment analysis based on news articles, social media posts, and other online content, helping to gauge the prevailing mood in the market.

- Price Movements Leading Up to Halving: Historically, price trends prior to a halving often reflect bullish sentiment as traders buy in anticipation of price increases.

Supply and Demand Dynamics

Source: zendesk.com

The dynamics of supply and demand play a crucial role in understanding the impact of Bitcoin halving events on its price. Halving events, which occur approximately every four years, reduce the rate at which new Bitcoins are created, effectively tightening the supply. This reduction in supply can trigger significant changes in market dynamics, especially when demand remains constant or increases.When Bitcoin undergoes a halving, the new supply of Bitcoin entering circulation is cut in half.

This shift can lead to a supply shortage if demand remains steady or grows, creating upward pressure on prices. Economic theories, particularly those rooted in classical economics, emphasize that a decrease in supply, with demand constant, usually results in a higher price. This relationship can be illustrated through the law of supply and demand, which states that if all other factors are equal, an increase in demand for a limited supply will elevate prices.

Examples of Economic Theories Related to Supply Reduction

Several economic theories illustrate the relationship between supply reduction and price increases, particularly in markets with limited resources like Bitcoin. Here are some key points to consider:

Scarcity Principle

The fundamental economic concept of scarcity posits that as a resource becomes less available, its value tends to increase. With Bitcoin’s finite supply of 21 million coins, each halving event increases the perceived scarcity, contributing to a potential rise in value.

Law of Supply and Demand

This principle asserts that when supply decreases while demand remains consistent, prices are likely to rise. This has been observable in Bitcoin’s historical price patterns following previous halving events, wherein prices surged in the months and years following the reductions in mining rewards.

Expectations Theory

Market participants often anticipate the effects of halving events in advance, leading to speculative buying. The expectation of future scarcity can drive demand up before the actual supply reduction occurs, further amplifying price increases.

“Historically, Bitcoin’s halving events have consistently led to significant price increases, illustrating the powerful relationship between reduced supply and elevated demand.”

Crypto Market Analyst

The interplay of these economic theories reflects the broader context in which halving events impact Bitcoin pricing. Watching for shifts in demand concurrent with supply reductions offers valuable insights into potential market movements, reinforcing the importance of these events in the cryptocurrency ecosystem.

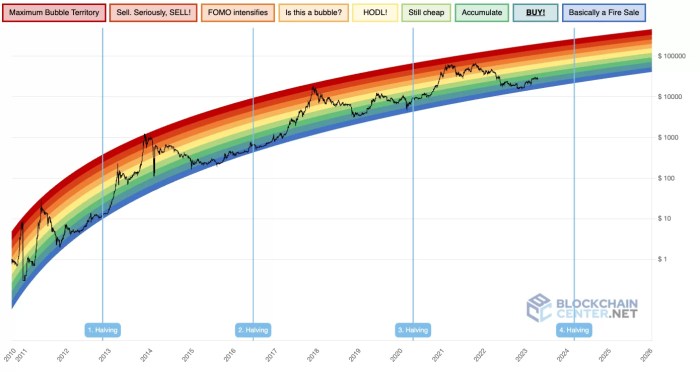

Future Predictions Based on Past Trends

Source: bitcoinsistemi.com

As we look ahead to the next Bitcoin halving, many analysts and experts are making predictions based on historical performance and market dynamics. Halving events have historically led to significant price movements, making this a crucial time for investors to assess potential outcomes. By understanding past trends, we can gain insights into what might lie ahead for Bitcoin’s price trajectory.Analyzing expert forecasts can provide a structured perspective on how Bitcoin may react in the upcoming period.

Here’s a comparison of various predictions from noted analysts, which may help investors to strategize their decisions effectively.

Expert Predictions Overview

The following table summarizes key predictions from different analysts regarding Bitcoin’s price movements leading into and following the next halving event, expected to occur in 2024.

| Analyst | Price Prediction (Post-Halving) | Time Frame | Rationale |

|---|---|---|---|

| PlanB | $100,000-$300,000 | 1 Year | Based on stock-to-flow model and historical patterns of post-halving prices. |

| Willy Woo | $90,000 | 6-12 Months | Utilizes on-chain data and market sentiment analysis to forecast bullish trends. |

| Tom Lee | $180,000 | End of 2024 | Focuses on institutional adoption and macroeconomic trends driving demand. |

| JPMorgan | $150,000 | Mid 2024 | Considers shortage in supply post-halving and growing interest from investors. |

The predictions above illustrate a range of expectations, indicating a general bullish sentiment among experts. Investors should consider these forecasts within the context of their own risk tolerance and investment horizon.Investors often use these predictions to inform their strategies. The optimistic outlook may encourage increased buying activity leading up to the halving, potentially driving prices higher. Conversely, if prices do not meet expectations, it may lead to volatility and reactions from market participants, emphasizing the importance of sound risk management practices.

“Understanding market sentiment in the lead-up to the halving can significantly impact investment strategies.”

Emerging market behaviors, influenced by these predictions, could also shape trading volumes and volatility around the halving date. Investors should remain vigilant and continuously assess the evolving landscape to make informed decisions in alignment with their financial objectives.

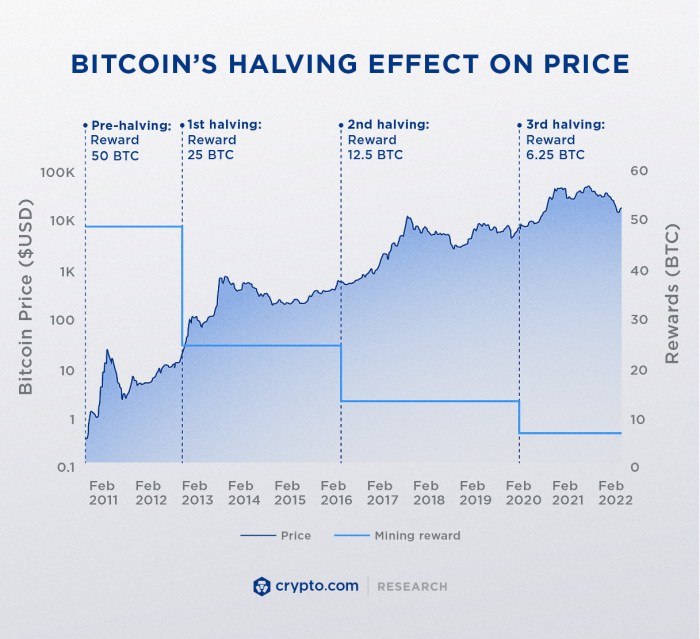

Emotional Reactions to Halving Events

Source: crypto.com

Halving events in the Bitcoin ecosystem trigger a diverse range of emotional reactions among traders and investors. These reactions often stem from the anticipation and subsequent reality of price changes, creating a volatile emotional landscape. Understanding these emotional dynamics is crucial for navigating the bullish and bearish swings that often follow such events.

The psychological aspects of trading can significantly influence how individuals react to market fluctuations. Following halving events, traders frequently experience heightened feelings tied to their expectations of price surges or declines. These emotions can lead to impulsive decisions that may not align with rational trading strategies.

Common Trader Behaviors Observed During Halving Events

During the periods surrounding halving events, several common behaviors emerge among traders, driven by their emotional reactions. Recognizing these patterns can help in making more informed trading decisions. Below is a summary of key trader behaviors observed during these crucial times:

- Anticipation and FOMO: Traders often exhibit a strong sense of excitement leading up to the halving, driven by the fear of missing out (FOMO). This anticipation can lead to increased buying activity as individuals seek to capitalize on potential price surges.

- Panic Selling: In the aftermath of a halving event, if prices do not surge as expected, traders may panic and engage in selling to cut losses. This behavior often exacerbates price declines.

- Herd Mentality: Traders are influenced by the actions of their peers, leading to a herd mentality where decisions are made based on what others are doing rather than on individual analysis.

- Overconfidence After Price Surges: Following significant price increases, many traders may feel overconfident, leading to aggressive buying and risk-taking that can result in substantial losses if the market corrects.

- Emotional Trading Decisions: Heightened emotions can cloud judgment, causing traders to make impulsive decisions that deviate from their original trading plans and strategies.

- Increased Volatility: The emotional landscape surrounding halving events often leads to increased market volatility, with rapid price swings reflecting traders’ collective sentiments.

These emotional dynamics highlight the importance of maintaining a disciplined approach to trading, especially during critical events like Bitcoin halving. Understanding one’s emotional responses can significantly impact trading outcomes and help mitigate risk in a highly volatile market.

Impacts on Mining Ecosystem

Halving events play a critical role in shaping the Bitcoin mining ecosystem, influencing miners’ profitability and operational strategies. With each halving, the reward for mining a block is cut in half, directly affecting the revenue streams for miners. This transformation prompts miners to adapt quickly, either by optimizing their existing operations or by investing in new technologies to maintain profitability in a changing landscape.The profitability of mining operations is significantly impacted by halving events, as the reduction in block rewards requires miners to either enhance their efficiency or rely on rising Bitcoin prices to sustain their revenue.

As Bitcoin’s supply becomes scarcer, it often leads to increased market interest, which can potentially boost prices. However, the immediate aftermath of a halving can create volatility, causing some miners to reassess their participation in the network based on their operational costs.

Changes in Mining Operations and Technologies, How Halving Events Affect Bitcoin Price

The halving events compel miners to innovate and adapt, as their profitability hinges on their ability to minimize costs and maximize output. Miners may pursue various strategies, including:

- Transitioning to more energy-efficient mining hardware, such as ASIC miners, which tend to provide better hash rates for lower energy consumption.

- Optimizing cooling systems and site locations to reduce electricity costs, especially in regions where energy prices are high.

- Collaborating in mining pools to increase the chances of successfully mining blocks collectively, thus smoothing out income volatility.

For example, after the 2020 halving, many miners shifted to the latest generation of ASIC miners which have higher efficiency levels. This shift illustrates a trend where competitive miners use technology advancements to stay ahead despite lower block rewards.The dynamics of mining pools also evolve significantly around halving events. Mining pools may experience shifts in membership as miners reassess their strategies in light of reduced rewards.

Before halving, pools might see an influx of miners wanting to maximize their chances of earning coins from anticipated price increases. Post-halving, however, less competitive miners may drop out if they can no longer sustain operations profitably, leading to consolidation within mining pools.Illustratively, before the 2020 halving, a mining pool may have had thousands of active participants. In the months following the event, as profitability became a challenge for less efficient miners, this number might decrease significantly as some miners exit the pool, opting to join larger, more capable mining entities that can weather the storm of reduced rewards.

Such adjustments underscore the continual evolution of the mining ecosystem, driven by the economic pressures introduced by halving events.

Summary

In summary, How Halving Events Affect Bitcoin Price highlights the intricate balance of supply, demand, and market psychology in the world of cryptocurrency. As we look to the future, it’s essential to consider how past trends might inform our understanding of upcoming halvings and their potential impacts on Bitcoin’s price trajectory. Ultimately, these events serve as a reminder of the volatility and excitement inherent in the cryptocurrency landscape.

Answers to Common Questions

What is a halving event?

A halving event is when the reward for mining new blocks is cut in half, reducing the rate at which new bitcoins are generated.

How often do Bitcoin halving events occur?

Bitcoin halving events occur approximately every four years, or every 210,000 blocks mined.

What historical price changes have followed halving events?

Historically, Bitcoin prices have experienced significant increases following halving events, although past performance is not always indicative of future results.

How does market sentiment change around halving events?

Market sentiment often becomes bullish leading up to and following halving events, with heightened media coverage influencing investor behavior.

What impact do halving events have on Bitcoin miners?

Halving events reduce miners’ rewards, which can impact their profitability and lead to changes in mining operations and technology.