How to Use Moving Averages in Crypto for Trading Success

How to Use Moving Averages in Crypto sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail. Moving averages have become an essential tool for traders seeking to navigate the volatile landscape of cryptocurrency markets. By smoothing out price data over a specific period, these averages help identify trends, making it easier to make informed decisions.

In this guide, we will explore the different types of moving averages, how to set them up on popular trading platforms, and the strategies that can elevate your trading game. With practical examples and common pitfalls to avoid, you’ll gain a comprehensive understanding of how to make moving averages work for you.

Introduction to Moving Averages in Crypto

Moving averages are a fundamental tool in the world of cryptocurrency trading, providing insights into price trends and helping traders make informed decisions. By averaging price data over a specified period, moving averages smooth out price fluctuations and highlight the overall trajectory of an asset. This technique is crucial for identifying potential buy and sell signals, making it an essential strategy for both novice and experienced traders alike.There are primarily two types of moving averages utilized in the cryptocurrency market: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

The SMA calculates the average price over a specific number of periods, giving equal weight to each data point. Conversely, the EMA applies more weight to recent prices, making it more responsive to new information. Understanding the differences between these types can greatly enhance a trader’s ability to analyze market movements.

Types of Moving Averages

Each type of moving average serves a distinct purpose in trading. Here’s a closer look at their characteristics and uses:

- Simple Moving Average (SMA): This is calculated by taking the sum of closing prices over a defined period and then dividing by the number of periods. For example, a 10-day SMA sums the last ten days’ closing prices and divides the total by ten. This average gives a clear picture of the price trend but can lag behind current prices during volatile market conditions.

- Exponential Moving Average (EMA): The EMA is more complex, as it applies a percentage of the most recent price to the previous EMA value. This results in a quicker response to price changes. For instance, a 10-day EMA will weigh the most recent prices more heavily than older ones, making it a favorite among day traders looking for timely signals.

Moving averages can be used to identify market trends through crossovers. A common strategy is the “Golden Cross” and “Death Cross.” A Golden Cross occurs when a short-term moving average crosses above a long-term moving average, suggesting a bullish trend, while a Death Cross occurs when the short-term moving average crosses below the long-term moving average, indicating a bearish trend.

“The 50-day SMA and 200-day SMA are often used to identify major trends in the cryptocurrency market, signaling potential entry or exit points.”

Traders often combine moving averages with other technical indicators to confirm trends and enhance their trading strategies. For instance, pairing moving averages with the Relative Strength Index (RSI) can provide deeper insights into market momentum and potential reversals.In summary, moving averages are invaluable for gauging the direction of cryptocurrency prices, helping traders navigate the often tumultuous waters of the market with greater confidence and accuracy.

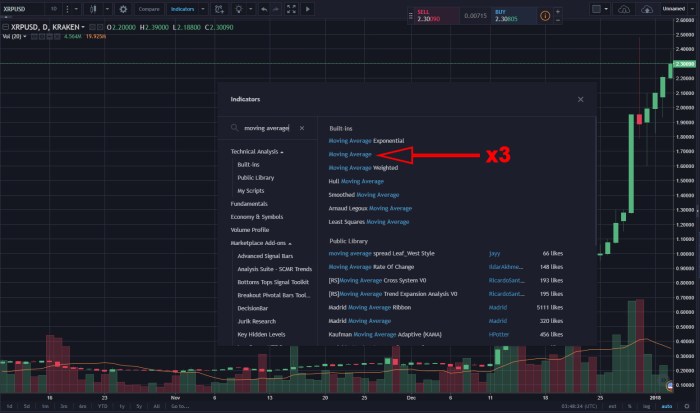

Setting Up Moving Averages on Trading Platforms

Source: beincrypto.com

Setting up moving averages on trading platforms is crucial for traders looking to analyze trends and make informed decisions in the volatile world of cryptocurrency. Moving averages help smooth out price action and provide a clearer view of the market direction, making them a popular tool among both novice and seasoned traders.To implement moving averages effectively, it’s essential to understand how to configure them on various trading platforms.

Each platform may have slightly different interfaces and options, but the fundamental principles remain the same. Below are detailed steps to set up moving averages on popular platforms such as Binance and Coinbase.

Steps to Implement Moving Averages on Binance

Binance provides an intuitive interface for adding moving averages to your charts. Here’s how to do it:

- Log into your Binance account and navigate to the ‘Markets’ tab.

- Select a cryptocurrency pair and open the trading chart.

- Click on the ‘Indicators’ button, usually found at the top of the chart.

- Type “Moving Average” in the search bar and select it from the list.

5. Adjust the settings by clicking the gear icon next to the indicator. Here you can set

Period Length

Common choices are 50, 100, or 200.

Type

Choose between Simple Moving Average (SMA) or Exponential Moving Average (EMA).Click ‘OK’ to apply the changes. Your moving average will now be displayed on the chart.

Steps to Implement Moving Averages on Coinbase

Coinbase offers a straightforward approach to adding moving averages. Follow these steps:

- Sign in to your Coinbase account and go to the ‘Trade’ section.

- Choose the cryptocurrency you want to analyze and open the price chart.

- Locate the ‘Indicators’ option, typically on the top menu of the chart.

- Search for “Moving Average” and select it.

5. Customize the moving average settings by clicking on its settings icon. Options to adjust include

Period

Adjust the length depending on your trading strategy.

Type

Toggle between SMA and EMA based on your preference for smoothing calculations.

Save your settings to view the moving averages on the chart.

Checklist for Configuring Moving Average Settings

Before you start using moving averages, it’s helpful to have a checklist to ensure you have set everything correctly. The following points should be considered:

Determine Your Trading Strategy

Understanding whether you’re swing trading, day trading, or investing long-term will influence the moving average settings.

Select the Period Length

Choose a short period (e.g., 9 or 20) for quick signals or a longer period (e.g., 50 or 200) for more stable insights.

Choose the Type

Decide whether to use SMA for a simple average or EMA for more weight on recent prices.

Set Alerts

If your platform allows, configure alerts for when the price crosses your moving average.

Comparison of Moving Average Functionalities on Different Platforms

Different trading platforms offer varying functionalities for moving averages. Here’s a comparison table:

| Platform | Moving Average Types | Custom Periods | Alerts | Chart Indicators |

|---|---|---|---|---|

| Binance | SMA, EMA | Yes | Yes | Multiple Indicators |

| Coinbase | SMA, EMA | Yes | Limited | Basic Indicators |

| Kraken | SMA, EMA | Yes | Yes | Advanced Indicators |

| Bitfinex | SMA, EMA | Yes | Yes | Multiple Indicators |

Understanding the moving average functionalities on different platforms can aid in making informed decisions on which platform to use based on your trading style and preferences. Moving averages can be powerful tools when set up correctly, allowing you to navigate the ever-changing crypto landscape with more confidence.

Strategies Using Moving Averages

In the dynamic world of cryptocurrency trading, moving averages serve as vital tools for traders seeking to optimize their strategies. By smoothing out price data over a specified period, they help identify trends and potential entry and exit points. Below, we delve into various trading strategies that leverage moving averages and how to implement them effectively.

Crossover Strategies

Crossover strategies are among the most popular methods utilizing moving averages. This strategy involves observing the intersections between two different moving averages: a shorter-term moving average and a longer-term moving average. The basic premise is straightforward: when the shorter-term average crosses above the longer-term average, it signals a potential buying opportunity, and when it crosses below, it indicates a potential selling point.

To create a moving average crossover strategy, follow these steps:

1. Select Moving Averages

Choose the types of moving averages to use, such as the Simple Moving Average (SMA) or Exponential Moving Average (EMA). A common combination is the 50-day EMA for the short term and the 200-day EMA for the long term.

2. Set Up Your Chart

Open your trading platform and set your selected moving averages on the price chart. Make sure to distinguish between the two averages through color coding.

3. Identify Crossover Points

Monitor the chart for the crossover points. A bullish signal occurs when the short-term moving average crosses above the long-term moving average, while a bearish signal happens when it crosses below.

4. Confirm with Volume

For increased reliability, confirm crossover signals with volume data. A significant increase in volume alongside a crossover can strengthen the signal’s validity.

5. Set Stop-Loss Orders

To manage risk effectively, set stop-loss orders just below the recent low for buy signals or above the recent high for sell signals.

6. Review and Adjust

Regularly review your strategy’s performance and make adjustments based on market conditions and your trading goals.

Enhancing Strategies with Other Technical Indicators

To boost the effectiveness of moving average strategies, combining them with other technical indicators can provide additional insights and reduce the likelihood of false signals. Here are some complementary indicators to consider:

Relative Strength Index (RSI)

The RSI measures the speed and change of price movements, which can confirm the strength of a trend. An RSI above 70 may indicate an overbought condition, while below 30 indicates oversold, refining entry and exit points.

MACD (Moving Average Convergence Divergence)

This indicator tracks the relationship between two EMAs. When the MACD line crosses above the signal line, it may reinforce a bullish crossover signal; conversely, a cross below could validate a bearish signal.

Bollinger Bands

These bands consist of a moving average and two standard deviations away from it. When prices reach the upper band, it can signal an overbought market, while reaching the lower band might indicate an oversold market. This helps traders gauge potential reversals.Incorporating these indicators with moving averages leads to a more robust trading strategy, allowing traders to make more informed decisions based on multiple data points and reducing the risk of relying solely on one indicator.

Analyzing Market Trends with Moving Averages

Source: cryptocurrencyhaus.com

Moving averages are essential tools in the world of crypto trading, allowing traders to filter out market noise and focus on the underlying price trends. By providing a smoothed view of price movements over specified periods, moving averages can help identify bullish and bearish trends effectively. Understanding how to analyze these trends can significantly enhance trading strategies and decision-making.Using moving averages to identify bullish and bearish trends relies primarily on the relationship between the moving average and the current price.

When the price is consistently above the moving average, it typically indicates a bullish trend. Conversely, when the price is below the moving average, it signals a bearish trend. Traders often employ different types of moving averages, such as the simple moving average (SMA) and exponential moving average (EMA), to gain insights into market conditions.

Interpreting Moving Average Crossovers and Divergences

Moving average crossovers occur when two different moving averages intersect, providing significant insights into potential trend reversals. Here’s how these crossovers can be interpreted:

- Golden Cross: This occurs when a short-term moving average crosses above a long-term moving average, suggesting a bullish trend is beginning. For instance, if the 50-day SMA crosses above the 200-day SMA, it may indicate a strong upward momentum.

- Death Cross: This happens when a short-term moving average crosses below a long-term moving average, signaling a potential bearish trend. An example is when the 50-day SMA crosses below the 200-day SMA, indicating a downward pressure on prices.

Divergences occur when the price of the asset and the moving average show opposite trends. For example, if the price is making new highs while the moving average is not, it may indicate weakening momentum and a potential reversal.

“Crossovers and divergences can serve as early indicators of market sentiment shifts, providing traders with valuable entry and exit points.”

Importance of Timeframes in Analyzing Moving Averages

The timeframe selected for moving averages plays a critical role in how trends are interpreted. Different timeframes can provide varying perspectives on market trends:

- Short-term Moving Averages: Typically used for day trading, these averages (e.g., 5-day or 10-day) allow traders to catch quick price movements but may also produce more false signals due to market volatility.

- Medium-term Moving Averages: Averages like the 20-day or 50-day are useful for swing trading, providing a balance between responsiveness and reliability in trend analysis.

- Long-term Moving Averages: The 200-day or longer averages are favored by long-term investors, as they provide a clearer view of the overall market trend and reduce the impact of short-term price fluctuations.

Choosing the appropriate timeframe is essential for aligning trading strategies with market conditions. Each timeframe can reveal different trends, and traders often use a combination of various moving averages to enhance their analysis and decision-making processes.

Common Mistakes and Misconceptions: How To Use Moving Averages In Crypto

Moving averages are widely regarded as one of the fundamental tools in technical analysis, particularly in the volatile world of cryptocurrency trading. However, their effectiveness can be overshadowed by common mistakes and misconceptions that traders often encounter. This section aims to shed light on these pitfalls, enabling traders to use moving averages more effectively and avoid potential losses.Understanding the limitations and drawbacks of moving averages is crucial.

While they serve as a helpful indicator of trends, they can also lead traders astray if applied incorrectly. Below are some of the most frequent mistakes and misconceptions associated with moving averages.

Common Pitfalls in Using Moving Averages

Many traders fall into traps that can hinder their trading performance. Recognizing these pitfalls is essential for anyone looking to leverage moving averages effectively.

- Over-reliance on Moving Averages: Many traders rely solely on moving averages without considering other indicators. This narrow approach can lead to missed opportunities or poor decision-making.

- Ignoring Market Conditions: Moving averages may not perform well in choppy or sideways markets. Traders often forget to account for the current market environment, leading to false signals.

- Neglecting Timeframes: Different timeframes can yield different signals. Traders sometimes fail to adjust their moving averages according to their trading strategy, leading to inconsistent results.

- Blindly Following Crossovers: While crossover strategies can be effective, relying solely on them without additional confirmation can lead to premature entries or exits.

- Not Accounting for Lag: Moving averages are lagging indicators, meaning they react to past price movements. Traders may misinterpret signals without recognizing this inherent delay.

Misconceptions Surrounding Moving Averages

There are several misconceptions about moving averages that can mislead traders and cloud their judgment. Understanding these can help clarify their proper use.

- Moving Averages Guarantee Success: Some traders believe that using moving averages will ensure profitable trades. In reality, they are just one tool among many, and success requires a comprehensive trading strategy.

- All Moving Averages are Equal: There is a misconception that all moving averages provide the same insights. Different types, such as simple moving averages (SMA) and exponential moving averages (EMA), have distinct characteristics that cater to various trading strategies.

- Moving Averages Predict Future Prices: A common misunderstanding is that moving averages can predict future price movements. They can only indicate past trends and should not be solely relied upon for forecasting.

Limitations of Moving Averages in Volatile Markets

In volatile markets, the effectiveness of moving averages can diminish significantly. Understanding these limitations is vital for traders looking to navigate such conditions.

- Increased False Signals: In highly volatile markets, moving averages may generate frequent false signals, leading to confusion and potential losses.

- Reduced Sensitivity: Standard moving averages may not respond quickly to rapid price changes, causing traders to miss critical entry or exit points.

- Whipsaw Movements: During periods of high volatility, prices may oscillate back and forth around the moving average, resulting in whipsaw movements that can trap traders into unprofitable positions.

“In trading, understanding your tools is just as crucial as the tools themselves.”

Case Studies and Real-World Applications

In the world of cryptocurrency trading, moving averages serve as powerful tools for traders to make informed decisions. By analyzing historical price movements through the lens of moving averages, traders can identify trends and potential entry or exit points. This section showcases notable case studies where moving averages played a crucial role in successful trades and highlights specific market scenarios that demonstrated their effectiveness.One of the significant advantages of utilizing moving averages is their ability to smooth out price data over a specified period, helping traders avoid the noise of short-term price fluctuations.

By observing how price interacts with moving averages, traders can make strategic decisions based on historical trends.

Successful Trades Using Moving Averages, How to Use Moving Averages in Crypto

Examining case studies of successful trades can illustrate the practical application of moving averages in real-world scenarios. Below are specific instances showcasing how traders leveraged moving averages to capitalize on market movements.

1. Bitcoin Bull Run (2020-2021)

During this period, many traders utilized the 50-day and 200-day moving averages to identify the onset of a bullish trend. As Bitcoin broke above the 50-day moving average, it signaled a potential upward momentum, prompting traders to enter long positions. The subsequent price surge validated the effectiveness of this strategy.

2. Ethereum Price Recovery (July 2021)

After a significant correction, Ethereum’s price began to recover. Traders observed the 20-day moving average as a key support level. Once the price consistently closed above this average, many traders entered positions, anticipating further upward movement. The resulting rally confirmed the reliability of the moving average as a trend indicator.

3. Litecoin’s Breakdown in Late 2021

In November 2021, Litecoin faced a substantial price decline. The 100-day moving average served as a resistance level during this downturn. Traders who closely monitored this moving average were able to avoid potential losses by exiting their positions once the price failed to breach this level, illustrating the protective capability of moving averages in bearish markets.

Market Scenarios Influenced by Moving Averages

Understanding specific market scenarios where moving averages significantly influenced trading decisions provides deeper insights into their utility. Here are examples of such scenarios:

Crossovers

A common strategy involves observing crossovers between short-term and long-term moving averages. For instance, when the 50-day moving average crosses above the 200-day moving average, it creates a “golden cross,” signaling potential bullish momentum. Conversely, a “death cross” occurs when the 50-day moving average crosses below the 200-day moving average, indicating bearish sentiment.

Trend Reversals

Moving averages can also signal potential trend reversals. When a price consistently bounces off a moving average, it indicates that the average may be acting as a strong support or resistance level. Traders often watch for these patterns to identify entry or exit points based on anticipated price movements.

Historical Price Movements and Moving Averages

To further illustrate the practical applications of moving averages, the following table demonstrates historical price movements alongside relevant moving averages. This data allows for a clearer understanding of how moving averages can influence trading decisions.

| Date | Price (USD) | 50-Day MA (USD) | 200-Day MA (USD) |

|---|---|---|---|

| January 1, 2021 | 30,000 | 32,500 | 28,000 |

| March 1, 2021 | 45,000 | 40,000 | 30,500 |

| May 1, 2021 | 55,000 | 50,000 | 35,000 |

| July 1, 2021 | 34,000 | 40,500 | 38,000 |

| September 1, 2021 | 41,000 | 45,000 | 39,500 |

This table exemplifies how traders can analyze price movements in relation to moving averages. Significant fluctuations in price relative to the moving averages can indicate potential trading opportunities, reinforcing the importance of moving averages in strategic decision-making.

Advanced Techniques and Future Trends

In the ever-evolving landscape of cryptocurrency trading, moving averages play a pivotal role. As traders seek to enhance their strategies and adapt to market conditions, understanding advanced techniques and future trends in moving averages becomes essential. This exploration delves into sophisticated methods, like adaptive moving averages, while also contemplating the impact of emerging technologies on these analytical tools.One advanced technique that has gained attention is the use of adaptive moving averages (AMAs).

Unlike standard moving averages, which apply a fixed time frame, AMAs adjust dynamically to market conditions. This flexibility allows them to respond to volatility and trend changes, providing traders with more relevant signals.

Adaptive Moving Averages

Adaptive moving averages are designed to improve the accuracy of trend detection by modifying their length based on market behavior. Here are some key characteristics and benefits of using AMAs:

- Responsiveness: AMAs react to price fluctuations, giving traders faster signals in volatile markets.

- Noise Reduction: By adapting to prevailing market conditions, AMAs can filter out market noise more effectively than traditional moving averages.

- Enhanced Flexibility: Traders can customize the responsiveness of AMAs to suit their trading style, whether they prefer conservative or aggressive approaches.

A popular implementation of AMAs is the Kaufman’s Adaptive Moving Average (KAMA), which uses volatility to calculate its smoothing factor. The formula for KAMA is:

KAMA = Previous KAMA + (SC x (Current Price – Previous KAMA))

where SC is the smoothing constant derived from price volatility. This adaptability allows traders to capitalize on market trends more efficiently.Looking ahead, the fusion of machine learning and moving averages is poised to revolutionize crypto trading. Machine learning algorithms can analyze vast datasets to identify patterns and adjust moving average calculations in real-time. The potential for these technologies includes:

Machine Learning Impact on Moving Averages

The integration of machine learning with moving averages offers innovative ways to refine trading strategies. Here are some anticipated advancements:

- Predictive Models: Algorithms can forecast price movements, optimizing moving average parameters based on historical data.

- Sentiment Analysis: Machine learning can process social media and news sentiment, adjusting moving averages to account for external influences on price.

- Automated Trade Execution: Traders can implement machine learning models that automatically adjust moving averages and execute trades based on predictive insights.

As these technologies continue to develop, they promise to enhance the effectiveness of moving averages, making them more than just tools for past price analysis but pivotal components of a proactive trading strategy. The combination of adaptive techniques and machine learning will shape the future of crypto trading, leading to more informed and responsive trading decisions.

Final Wrap-Up

Source: profitableinvestingtips.com

In summary, understanding how to use moving averages in crypto can significantly enhance your trading strategy. Whether you’re a novice or an experienced trader, incorporating moving averages allows you to better identify market trends and make more informed decisions. By combining these averages with other technical indicators, you can refine your approach and potentially increase your success in the dynamic world of cryptocurrency trading.

Question & Answer Hub

What are the main types of moving averages?

The main types of moving averages include Simple Moving Averages (SMA) and Exponential Moving Averages (EMA), each serving different purposes based on the calculation method used.

How can moving averages help with market timing?

Moving averages can signal potential entry and exit points by indicating bullish or bearish trends when the price crosses above or below the average.

Are moving averages suitable for all cryptocurrencies?

While moving averages can be applied to any cryptocurrency, their effectiveness may vary based on market volatility and trading volume.

What period length should I choose for moving averages?

The period length depends on your trading strategy; shorter periods are better for day trading while longer periods suit swing trading.

Can moving averages predict future prices?

Moving averages do not predict future prices but help identify trends that may indicate future price movements.