How to Use On-Chain Data for Trading Decisions Effectively

Starting with How to Use On-Chain Data for Trading Decisions, this exploration dives into the pivotal role on-chain data plays in crafting informed trading strategies. In the rapidly evolving landscape of blockchain and cryptocurrencies, understanding the nuances of on-chain data is essential for traders aiming to enhance their decision-making process. This data not only reflects the behavior of market participants but also uncovers trends that can significantly impact trading outcomes.

From identifying critical metrics to leveraging various platforms for data access, the journey into on-chain analysis equips traders with the insights necessary to predict price movements and refine their strategies. By integrating this data with traditional technical analysis, traders can create a robust framework that maximizes their trading potential.

Understanding On-Chain Data

On-chain data refers to the information that is recorded on a blockchain. This data is public and immutable, providing transparency in transactions and activities within the blockchain ecosystem. The significance of on-chain data in trading decisions cannot be overstated, as it allows traders to analyze historical trends, assess current market conditions, and make informed predictions about future price movements.On-chain data encompasses a variety of transaction-related information.

This includes, but is not limited to, transaction volumes, wallet balances, and the number of active addresses. By examining this data, traders can gain insights into market sentiment, liquidity, and overall network activity, all of which are crucial for making informed trading decisions. Understanding the types of on-chain data available and their implications can significantly enhance a trader’s strategy.

Types of On-Chain Data

Various types of on-chain data can be analyzed to inform trading strategies. Each type offers unique insights into market dynamics, and traders should be aware of their significance.

- Transaction Volume: This represents the total number of transactions executed within a specific timeframe. High transaction volumes often indicate increased activity and can signal potential price movements.

- Wallet Balances: By analyzing the balances of different wallets, traders can identify trends in accumulation or distribution. A significant increase in large wallet balances may suggest bullish sentiment.

- Active Addresses: The number of unique addresses participating in transactions serves as a metric for network activity. An increase in active addresses may indicate growing interest in a particular cryptocurrency.

- Hash Rate: For Proof-of-Work blockchains, the hash rate reflects the computational power securing the network. A rising hash rate can indicate a healthy network and investor confidence.

The following key metrics derived from on-chain data are essential for traders to consider when making decisions:

Key Metrics for Informed Decision-Making

Traders should focus on specific metrics within on-chain data to better inform their trading strategies. These metrics can reveal underlying market trends and assist in predicting price movements.

- Network Growth: Analyzing the growth of the network helps traders understand the long-term viability of a cryptocurrency. Increased network growth can signal a bullish outlook.

- Supply Metrics: Understanding the circulating supply, total supply, and inflation rate of a cryptocurrency can impact its price. Scarcity can drive demand, influencing traders’ decisions.

- Transaction Fees: Monitoring changes in transaction fees provides insights into network congestion. High fees may deter users, indicating a potential dip in activity.

- Whale Activity: Keeping track of large transactions made by “whales” can provide clues about market sentiment. A series of large purchases may indicate an upcoming price surge.

In summary, leveraging on-chain data allows traders to make data-driven decisions based on real-time insights from the blockchain. By analyzing various types of on-chain data and focusing on key metrics, traders can better navigate the complexities of the cryptocurrency market.

Sources of On-Chain Data

On-chain data serves as a valuable resource for traders looking to make informed decisions in the cryptocurrency market. It provides insights into transaction histories, wallet activities, and network dynamics that are essential for analysis. Various platforms and tools make it easier for traders to access and interpret this data effectively.

Popular Platforms and Tools for Accessing On-Chain Data

Several platforms offer robust access to on-chain data. Each platform has unique features that cater to different aspects of blockchain analysis. Below is a list of some of the most popular on-chain data providers, along with a brief overview of their offerings:

- Glassnode: Provides advanced on-chain metrics and indicators, focusing on market behavior and network activity. Glassnode is especially known for its user-friendly interface and comprehensive analysis tools.

- CryptoQuant: Offers real-time blockchain data and market analytics. CryptoQuant emphasizes exchange flows and miner statistics to aid in trading decisions.

- IntoTheBlock: Features a range of indicators and insights based on on-chain data, including transaction volume and ownership concentration. It is useful for identifying market trends.

- Coin Metrics: Delivers a wide array of on-chain and off-chain data, focusing on transparency and institutional-grade analytics. Coin Metrics is often used by professional investors and analysts.

- Blockchair: A versatile blockchain explorer that allows users to explore transactions, addresses, and blocks on multiple chains. Blockchair also offers an API for developers to integrate blockchain data into their applications.

Comparison of On-Chain Data Providers

When selecting an on-chain data provider, it is essential to consider various features and offerings. The following table summarizes key attributes of leading platforms:

| Provider | Key Features | Pricing Model | Target Audience |

|---|---|---|---|

| Glassnode | On-chain metrics, market insights, and alerts | Free tier available, subscription options for advanced features | Retail and institutional investors |

| CryptoQuant | Real-time data, exchange flows, miner statistics | Free tier with limited access, premium plans available | Traders and analysts |

| IntoTheBlock | Comprehensive indicators, ownership metrics | Subscription-based pricing | Traders and analysts |

| Coin Metrics | Institutional-grade analytics, transparency | Custom pricing based on usage | Institutional investors |

| Blockchair | Multi-chain explorer, API access | Free access with premium features | Developers and researchers |

Methods to Extract On-Chain Data from Blockchain Explorers and APIs

Extracting on-chain data can be accomplished through blockchain explorers and APIs. Blockchain explorers are web-based tools that provide a user-friendly interface for viewing and analyzing blockchain transactions. On the other hand, APIs allow developers to programmatically access blockchain data for integration into applications.Using a blockchain explorer, users can manually search for specific transactions, view block details, and analyze wallet activities.

This method is straightforward and works well for individual transactions or small-scale analysis. For more extensive data retrieval, APIs are instrumental. They allow for automated data extraction and can handle large volumes of information efficiently. Many popular blockchain data providers offer APIs that developers can use to pull data such as transaction histories, balances, and network statistics.

“APIs enable seamless integration of on-chain data into trading algorithms, enhancing decision-making capabilities.”

In summary, accessing on-chain data through reliable platforms and utilizing blockchain explorers and APIs significantly enhances a trader’s ability to make informed decisions. The choice of tools and methods will depend on the specific needs and goals of the user.

Analyzing On-Chain Data for Market Trends

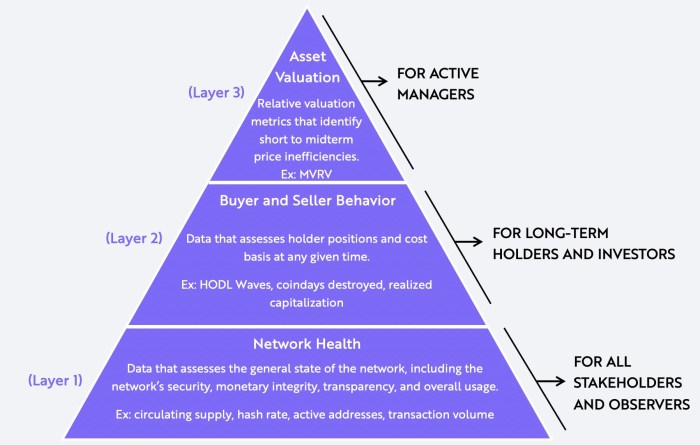

Source: substackcdn.com

On-chain data provides unique insights into market trends that traditional trading indicators may overlook. By interpreting blockchain activity, traders can identify patterns that indicate potential future price movements. This understanding can drive informed decision-making and enhance trading strategies.Analyzing on-chain data involves several techniques that illuminate market trends. By leveraging metrics such as transaction volume, active addresses, and network growth, traders can gain a clearer picture of market dynamics.

These insights can be visualized to simplify the analysis and highlight critical trends, allowing for more effective prediction of price movements.

Techniques for Identifying Market Trends

To effectively identify market trends through on-chain data, traders can apply the following techniques:

- Transaction Volume Analysis: Monitoring the number of transactions over time helps to identify increasing or decreasing market activity. A spike in transaction volume often precedes price movements.

- Active Addresses Tracking: Observing the number of active addresses provides insights into user engagement. A growing number suggests increased interest in the asset, which may indicate an upward trend.

- Whale Activity Monitoring: Following large transactions can reveal movements by significant holders (whales) that may impact market sentiment and price direction.

- Net Position Changes: Analyzing the net position of addresses (i.e., whether they are accumulating or distributing assets) can signal bullish or bearish trends.

Effective Visualization of On-Chain Data

Visualizing on-chain data is crucial for simplifying complex information and highlighting trends. Here are effective methods to accomplish this:

- Line Charts: Ideal for showing price trends over time, these charts can be overlaid with transaction volume to reveal correlations between trading activity and price movements.

- Bar Graphs: Useful for displaying transaction counts and active addresses, bar graphs can illustrate trends in user engagement and network activity.

- Heat Maps: These can indicate areas of high transaction activity or address density, providing a visual representation of market hotspots.

- Dashboards: Combining various visual representations into a single interface allows traders to monitor multiple metrics simultaneously, facilitating quicker and more informed decision-making.

Step-by-Step Procedure for Predicting Price Movements

Using on-chain data to predict price movements requires a structured approach. Here’s a step-by-step procedure:

- Gather On-Chain Data: Use reliable blockchain analytics platforms to collect relevant on-chain metrics such as transaction volume, active addresses, and wallet balances.

- Identify Key Metrics: Determine which metrics are most pertinent to your analysis. For example, focusing on transaction volume and active addresses can provide insights into market momentum.

- Visualize the Data: Create visual representations of the chosen metrics, such as line charts or bar graphs, to easily identify trends and anomalies.

- Analyze Correlations: Look for correlations between price movements and the on-chain metrics you’ve visualized. For instance, a substantial increase in active addresses alongside price appreciation may signal a strong bullish trend.

- Develop Trading Strategies: Based on your analysis, formulate your trading strategies. For example, if increased transactions are observed before a price spike, consider entering a position early.

- Monitor and Adjust: Continuously monitor on-chain data and adjust your strategies as necessary to adapt to changing market conditions.

Integrating On-Chain Data with Technical Analysis

Combining on-chain data with traditional technical analysis creates a powerful framework for traders, enhancing decision-making and improving market predictions. This integration allows traders to leverage the strengths of both methodologies, cultivating a more informed trading strategy that captures market trends effectively.Integrating on-chain data into technical analysis involves using data derived from blockchain transactions, wallet addresses, and network activity along with conventional price charts and indicators.

This fusion can provide deeper insights into market sentiment and potential price movements, enabling traders to make more informed decisions.

Combining On-Chain Insights with Technical Indicators

The importance of merging on-chain data with technical indicators lies in the ability to validate price movements and trends. Traders can adopt specific on-chain metrics to enhance traditional technical analysis, providing a multi-faceted view of market dynamics. Below are key indicators derived from on-chain data that can complement traditional analysis:

- Network Activity: Monitoring the number of active addresses or transaction volume can signal changes in investor interest. For instance, an increase in daily active addresses often correlates with rising prices, indicating growing market engagement.

- Whale Transactions: Large transactions from major holders (whales) can impact price movements significantly. Observing these transactions alongside price action can provide insights into potential market reversals or bullish trends.

- Market Value to Realized Value (MVRV) Ratio: This metric compares the market cap of a cryptocurrency to its realized market cap. A high MVRV might signal overvaluation, while a low ratio can indicate an undervalued asset.

- Exchange Flows: Analyzing the inflow and outflow of coins to exchanges can indicate market sentiment. High inflows may suggest selling pressure, while significant outflows could indicate accumulation and positive sentiment.

A structured framework for developing a trading strategy that incorporates both on-chain data and technical indicators can enhance trade execution. Here’s a proposed approach:

1. Define Objectives and Risk Tolerance

Establish clear trading goals and determine acceptable levels of risk.

2. Select Relevant On-Chain Metrics

Identify on-chain indicators that align with your trading strategy, focusing on those that provide insights into market sentiment and potential price movements.

3. Conduct Technical Analysis

Utilize traditional technical indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) alongside on-chain metrics to analyze price charts.

4. Create Trading Signals

Combine insights from both datasets to develop entry and exit signals. For example, if the RSI indicates overbought conditions and whale transactions are increasing, this may signal a forthcoming price correction.

5. Backtest Your Strategy

Use historical data to test the effectiveness of your strategy. Validate the integration of on-chain data and technical indicators to ensure the strategy’s robustness.

6. Monitor and Adjust

Continuously track performance and adjust the strategy based on changing market conditions and new on-chain data. Staying adaptable is key to optimizing trading decisions.This integrated approach allows traders to harness the strengths of both on-chain data and traditional technical analysis, creating a well-rounded strategy that enhances market understanding and improves trading performance.

Case Studies of Successful On-Chain Trading

The application of on-chain data in trading strategies has proven to be a powerful tool for traders looking to gain an edge in the volatile cryptocurrency markets. By analyzing blockchain data, traders can uncover insights that are often hidden from traditional market analysis. This section explores several successful trading strategies that effectively utilized on-chain data, along with detailed case studies illustrating decision-making processes based on these insights.

The impact of significant on-chain events on market reactions and trading outcomes is also analyzed.

Successful Trading Strategies Utilizing On-Chain Data

In recent years, several traders have successfully harnessed on-chain data to optimize their trading strategies. The following list highlights key strategies that exemplify this approach:

- Whale Activity Monitoring: Traders closely tracking large wallet movements often adjust their positions based on the actions of prominent holders. For instance, in early 2021, a notable increase in Bitcoin transactions from a major wallet preceded a price surge, prompting traders to buy in anticipation of further increases.

- Supply and Demand Analysis: Observing the inflow and outflow of assets from exchanges can indicate potential price movements. In mid-2020, a decreased outflow of Ethereum from exchanges suggested a bullish trend, leading many traders to enter the market, resulting in significant profit as prices rose.

- Network Activity Assessment: Analyzing metrics such as active addresses and transaction volumes can signal changes in market sentiment. In late 2020, a spike in active Bitcoin addresses correlated with a price rally, which traders leveraged to capitalize on the upward momentum.

Case Study: Bitcoin Whale Transactions and Price Movements

A notable case study highlighting the effectiveness of on-chain data involves major whale transactions. In March 2021, a single Bitcoin address moved over 10,000 BTC after being dormant for over a year. This movement triggered significant speculation in the market.Traders observed the transaction closely, understanding that such large movements often result in price fluctuations. As a result, many opted to exit positions to avoid potential downturns, while others viewed it as an opportunity to buy at a lower price.

The market reacted with volatility, showcasing the influence of on-chain data on trading decisions.

Market Reactions to Significant On-Chain Events

Market reactions to on-chain events can significantly impact trading outcomes. Here are a few instances where traders capitalized on these occurrences:

- Ethereum Network Upgrades: The London Fork in August 2021 created a substantial buzz among traders. By analyzing on-chain data regarding the burn rate of ETH, many traders anticipated a deflationary effect, leading to price increases post-upgrade.

- Bitcoin Halving Events: Historically, Bitcoin halving events have led to bullish market trends. In the 2020 halving, traders utilizing on-chain analysis noted a decrease in block rewards, prompting them to accumulate Bitcoin in anticipation of future scarcity and price appreciation.

- Large Institutional Purchases: In late 2020, news of significant institutional investments, such as MicroStrategy’s Bitcoin purchase, led to increased on-chain activity. Traders who closely monitored these purchases acted quickly, resulting in substantial gains as Bitcoin’s price surged in the following months.

Traders effectively using on-chain data can anticipate market movements and make informed decisions that result in profitable trades.

Risks and Limitations of Using On-Chain Data

Source: cex.io

On-chain data offers traders unique insights into the blockchain and cryptocurrency markets, but it is essential to recognize that it comes with its share of risks and limitations. When relying solely on on-chain data for trading decisions, traders can encounter several pitfalls that may affect their strategies and outcomes. Understanding these risks is critical for effective trading and informed decision-making.One of the main challenges of using on-chain data is its inherent complexity.

Interpreting on-chain metrics requires a solid understanding of blockchain technology and the various factors that influence market behavior. Inaccurate or misinterpreted data can lead to poor trading decisions. Additionally, on-chain data is often subject to delays, which can result in outdated information that may not accurately reflect the current market conditions.

Potential Pitfalls of On-Chain Data, How to Use On-Chain Data for Trading Decisions

Several pitfalls can arise when utilizing on-chain data for trading. The following points highlight the primary risks associated with this approach:

- Data Overload: The sheer volume of data available can be overwhelming, making it difficult to discern meaningful trends and signals.

- Limited Context: On-chain metrics do not always provide context for price movements, as they often reflect historical data rather than real-time influences.

- Manipulation Risks: The blockchain can be susceptible to manipulation; large holders, or “whales,” can create misleading on-chain signals through strategic buying or selling.

- Network Congestion: High transaction volumes can lead to network congestion, affecting data retrieval and increasing latency in decision-making.

Mitigating these risks involves employing best practices to ensure more reliable decision-making. Understanding the limitations of on-chain data allows traders to adopt a more nuanced approach to their analyses.

Mitigating Risks When Relying on On-Chain Data

To navigate the risks associated with on-chain data, traders can adopt several strategies that enhance accuracy and reliability. These methods can help create a more balanced trading approach:

- Diversification of Data Sources: Incorporate off-chain data, such as market news and sentiment analysis, to gain a comprehensive view of the market landscape.

- Use of Analytical Tools: Leverage advanced analytical tools and software to filter and visualize on-chain data more effectively, making it easier to identify relevant trends.

- Setting Risk Parameters: Establish clear risk management protocols to determine entry and exit points based on both on-chain and off-chain indicators.

- Continuous Education: Stay informed about blockchain technology and market dynamics to improve your understanding of how on-chain data correlates with price movements.

Comparative Reliability of On-Chain Data Versus Off-Chain Data

Understanding the reliability of on-chain data in contrast to off-chain data is crucial for making informed trading decisions. Each type of data has its strengths and weaknesses:

- On-Chain Data: Directly reflects transaction volumes, wallet activities, and network health, providing transparency and real-time insights into blockchain behavior.

- Off-Chain Data: Includes market sentiment, trading volumes from exchanges, and macroeconomic indicators; this data can show implications that on-chain metrics may miss.

- Reliability Comparison: While on-chain data is sometimes viewed as more objective, it can lack context. Meanwhile, off-chain data may incorporate market sentiment that can drive price movements more dynamically.

Considering the strengths and weaknesses of both types of data helps traders create a more robust trading strategy that leverages the benefits of on-chain insights while compensating for their limitations.

Future Trends in On-Chain Data Utilization

As the blockchain ecosystem continues to evolve, the utilization of on-chain data is poised to enter new and exciting territories. Traders are increasingly recognizing the value of on-chain analytics, and as technology advances, the possibilities for leveraging this data grow exponentially. This section delves into the innovative trends that are set to shape the future of on-chain data in trading decisions.

Emerging Technologies Enhancing On-Chain Data Usage

Several emerging technologies are likely to enhance the utilization of on-chain data, providing traders with more robust tools for analysis and decision-making. These technologies include:

- Artificial Intelligence (AI) and Machine Learning: AI-driven algorithms can analyze vast quantities of on-chain data at unprecedented speeds, identifying patterns and trends that human analysts may overlook. This allows for more accurate predictions and smarter trading strategies.

- Advanced Data Visualization Tools: Next-generation data visualization platforms enable traders to interpret complex on-chain data more intuitively. Visual representations can help highlight trends, correlations, and anomalies, making it easier to make informed trading decisions.

- Decentralized Finance (DeFi) Integrations: As DeFi platforms become more sophisticated, they increasingly incorporate on-chain data analytics. This integration allows traders to access real-time market insights, facilitating more efficient trading within decentralized exchanges.

Regulatory Impacts on On-Chain Data Accessibility

With the growing importance of on-chain data, regulatory frameworks are also beginning to take shape. These regulations may significantly impact how traders access and analyze data. Key considerations include:

- Data Privacy Regulations: As governments worldwide implement stricter data privacy laws, traders may face challenges in accessing certain on-chain data. Regulations such as GDPR in Europe could impose limitations on how data is collected and utilized.

- Compliance Requirements: Increased scrutiny on cryptocurrency transactions may compel traders to adopt more robust compliance measures, impacting the way on-chain data is analyzed and reported.

- Standardization of Data Formats: Regulatory bodies may push for standardized reporting formats for on-chain data, which could streamline analysis but also require traders to adapt to new compliance procedures.

Innovative Approaches for Utilizing On-Chain Data

As the landscape of on-chain data continues to shift, traders are likely to adopt innovative approaches that will redefine their trading strategies. Notable trends include:

- Sentiment Analysis: Many traders are beginning to incorporate sentiment analysis tools that gauge market sentiment from social media and news sources alongside on-chain metrics. This multi-faceted approach provides a more comprehensive view of market conditions.

- Predictive Analytics: By leveraging historical on-chain data, traders can build predictive models that forecast future price movements. These models can incorporate factors like transaction volume and network activity to enhance accuracy.

- Cross-Chain Data Integration: As multiple blockchains gain traction, the ability to analyze on-chain data across different chains will become crucial. Traders may develop strategies that exploit discrepancies between various blockchain ecosystems.

“The future of trading lies in the ability to harness and interpret on-chain data, transforming raw metrics into actionable insights.”

Last Word: How To Use On-Chain Data For Trading Decisions

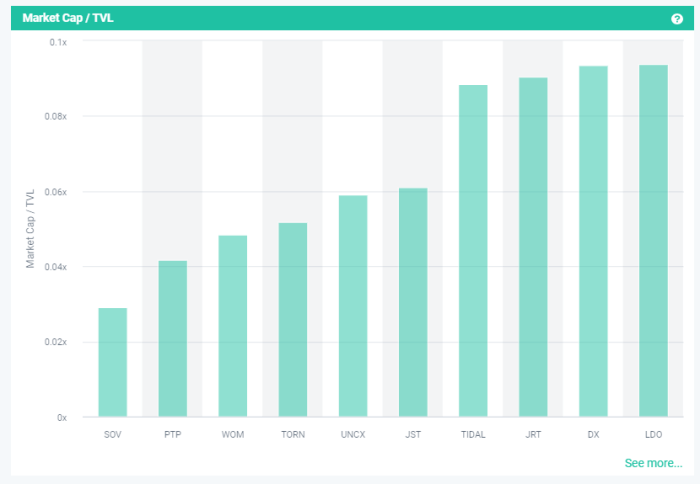

Source: altfins.com

In conclusion, mastering the use of on-chain data for trading decisions offers a powerful edge in today’s competitive market. By understanding its significance, analyzing key trends, and recognizing potential risks, traders can navigate the complexities of blockchain investments with greater confidence. The future of trading lies in the seamless integration of on-chain insights, making it imperative for traders to stay ahead of the curve and adapt to emerging technologies and methodologies.

Q&A

What is on-chain data?

On-chain data refers to information that is recorded on a blockchain, including transaction histories, wallet activities, and smart contract interactions, which can be analyzed for insights into market behavior.

How can I access on-chain data?

You can access on-chain data through platforms like blockchain explorers, APIs, and specialized analytics tools designed for cryptocurrency analysis.

What are the risks of using on-chain data?

Risks include data misinterpretation, reliance on incomplete information, and potential inaccuracies in data reporting, which can lead to poor trading decisions.

How does on-chain data complement technical analysis?

On-chain data provides insights into market sentiment and liquidity, which can be used alongside traditional technical indicators to develop more comprehensive trading strategies.

Are there limitations to on-chain data?

Yes, limitations include the potential for delayed data updates, the need for specialized knowledge to interpret the data correctly, and varying quality among data providers.